07.31.24

Center for Green Market Activation Shares Insights on SBTi’s Recent Technical Outputs

By GMA

On July 30, the Science Based Targets Initiative (SBTi) published four technical outputs as part of its process to revise the SBTi Corporate Net Zero Standard. The Center for Green Market Activation and the Zero Emission Maritime Buyers Alliance co-published the following early takeaways:

- 1. These outputs start SBTi, the world’s largest validator of corporate climate goals, down a promising path towards providing companies with additional tools through which they can demonstrate progress towards ambitious Scope 3 goals.

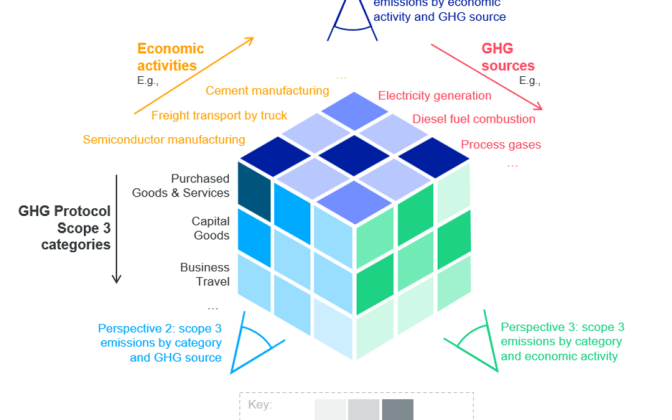

2. Among other options, SBTi is exploring the role of environmental attribute certificates (EACs) – instruments that represent and communicate the environmental and/or climate-related attributes of commodities, activities, or projects – in addressing value chain emissions. The consideration of EACs differed from traditional carbon credits, which they stated could not be counted as emission reductions toward science-based targets.

3. While SBTi said that more work is needed before firm guidance can be given, they are particularly focused on exploring EACs derived from chain of custody models like book and claim systems. Book and claim systems separate environmental attributes from physical commodities, making it easier to connect customers willing to pay a premium with providers of green goods and services. Both the Sustainable Aviation Buyers Alliance (SABA) and the Zero Emission Maritime Buyers Alliance (ZEMBA) utilize book and claim systems in their efforts to aggregate and operationalize demand for low and zero carbon aviation and maritime fuels.

4. SBTi emphasized that usage of such book and claim systems should come with clear guardrails and potentially be limited to sources that can demonstrably lead to net-zero aligned market transformation. These comments provide a strong signal to companies to focus their investments on the highest quality EACs.

5. The Advanced and Indirect Mitigation (AIM) Platform is called out as an example of current work underway to provide greater clarity and direction on EACs.

We look forward to working with SBTi and through the AIM Platform to bring comfort and build the evidence base for EACs usage towards climate goals.

“We welcome the latest release of technical outputs of SBTi and are grateful for the hard work that went into them,” said GMA CEO Kim Carnahan. “These outputs highlight the role that EACs could play in driving deep decarbonization of supply chains and the imperative for clear standards and guidance around their use. We couldn’t agree more. Coupling strong guardrails with new tools for value chain decarbonization could unleash urgently needed investment in clean fuels and materials. We realize we aren’t there yet, but we are excited to continue to engage with SBTi as they move forward with this essential work.”

GMA encourages all stakeholders to read SBTi’s materials and engage with them on a path toward updated Scope 3 guidance.

07.30.24

Q&A with Sustainable Aviation Futures

By GMA

As published in a July 2024 newsletter issued by Sustainable Aviation Futures, GMA’s Andre de Fontaine and Alex Coulombe recently contributed to a Q&A describing our work with the Sustainable Aviation Buyers Alliance (SABA), and how technology, business model innovation, policy incentives, and voluntary investments into SAF certificates are helping drive the SAF market and supporting the decarbonization of the aviation sector.

Click here to read the full article on the Sustainable Aviation Futures website, or see the excerpted Q&A below:

Can you tell us a bit about your organization?

While our launch as an NGO is relatively recent, we’ve been active in value chain decarbonization efforts for many years through predecessor organizations and joint initiatives. Introduced in June 2024, the Center for Green Market Activation (GMA) is a US-based, globally focused nonprofit that works with climate-leading companies and non-profits to jump start new markets in green fuels and materials. Through innovative book-and-claim systems, new and creative procurement approaches, and demand aggregating buyers’ alliances, GMA catalyzes and scales the uptake of low-carbon goods and services in the hardest-to-abate sectors.

GMA leverages deep expertise across industries. The GMA team has served as the Secretariat for the Sustainable Aviation Buyers Alliance (SABA) since its inception in 2021, and now also supports the Zero Emission Maritime Buyers Alliance (ZEMBA), in addition to recently launching GMA Trucking to support decarbonization in the logistics sector. Cement and concrete (in partnership with RMI) along with chemicals are other emerging programs under the GMA umbrella.

Kim Carnahan, GMA’s CEO, has over 15 years of experience in climate change and energy, including serving as the Chief Negotiator for Climate Change at the US Department of State. Over nearly a decade at the State Department, she managed the 13-government agency team that negotiated the Paris Agreement and its implementing guidance as well as energy and environment agreements at the International Civil Aviation Organization (ICAO) and International Maritime Organization (IMO). She has a deep background in environmental markets, having previously served as the International Policy Director at the International Emissions Trading Association, and is an is an expert on alternative fuels as evidenced by her time as Senior Director for Net Zero Fuels with ENGIE Group. Kim spearheaded the launch of the Sustainable Aviation Buyers Alliance (SABA) in 2021, in partnership with Environmental Defense Fund and RMI. She continues to manage SABA and is expanding its success to other hard-to-abate sectors.

What do you believe will be the biggest contributor to decarbonizing the aviation industry in the next 20 years?

We can’t choose between technology innovation and business model innovation! On the one hand, development and maturation of SAF technologies that can reach near-zero or zero emissions with sustainable and scalable feedstocks and can be blended at higher quantities with conventional jet fuel is critical. With e-fuels, the primary inputs are renewable energy and waste carbon, and this combination creates an extremely low emissions fuel with fewer constraints on long-term feedstock supplies. Scaling e-fuels will be a game-changer for this industry. On the other hand, SAF is more expensive than conventional jet fuel, so new business models that expand the investment opportunity across stakeholders, including corporate customers seeking to meet ambitious climate targets, will be equally as important to drive capital into the SAF market and help fuel providers scale production. Airlines and fuel producers that leverage a program like SABA to allow air travel and air freight customers to invest in SAF certificates and address their Scope 3 aviation emissions will get ahead in this market.

Do you see SAF and aviation decarbonization fitting into the political agenda, either in the USA or globally?

SAF policies are found at state, national, and global levels, and can take different forms, ranging from volumetric blending mandates to financial incentives like tax credits. The overall global trend appears to be moving toward greater policy support for SAF investment and production, recognizing the hard-to-abate nature of aviation sector emissions. Still, we find that voluntary investments into SAF, such as those facilitated by our work with SABA, are taking place independent of political cycles. Indeed, the private sector, voluntary market and established book and claim mechanisms can provide a steady demand signal to ensure funding and offtake for SAF volumes even if government programs and incentives shift depending on the prevailing political winds.

To describe a bit more how this works through the SABA model, our market-based solution enables fuel providers to sell the physical SAF to an airline, while a corporate customer purchases the associated environmental attributes in the form of a “scope 3” SAF certificate. The price for the SAF certificate is usually set at some portion of the “green premium”, i.e. the difference in price between the SAF and conventional jet fuel.

How important is public and political support in the acceleration of SAF production, does one come before the other?

Public and political support are both important to accelerate SAF production- and can occur together in a mutually reinforcing manner. At nearly double the cost, SAF comes at a high premium to conventional jet fuel. Government incentives allow fuel providers to bring down the cost to air transport providers, making investment in SAF more attainable to offtakers.

A significant portion of this investment, so far, has come from corporations purchasing SAF certificates to reduce their business travel emissions and meet ambitious net zero targets. For example, SABA’s most recent multi-year RFP is channeling close to $200 million from 20 corporate companies to purchase SAF certificates – equal to about 50 million gallons of SAF. As investment continues to flow in the market, and public awareness of SAF and its benefits grows, we expect political and policy support to increase as well, providing a further prod to the market.

In 2024 almost half the global population has, or will, vote, with elections held notably in the USA, Brazil, the UK, the EU, and Australia. What impact do you think changes in political leadership could have on the funding and development of SAF production?

Variability in administration may impact government funding and incentives for SAF production, but we think the overall production trajectory will continue its upward climb, supported in part by the growing interest among voluntary corporate buyers. Corporate net zero commitments are already having an impact in driving technology adoption and market transformation in the aviation sector, and we expect that trend to continue not just within the SAF market, but other hard to decarbonize sectors as well.

Selecting a region of your choice, what do you believe needs to happen in policy to enable the aviation industry to meet net zero by 2050?

In the US, we need both policy and private sector support to reach net zero aviation by 2050. Across public and corporate-driven initiatives, we must invest in technologies that will provide pathways to deep decarbonization, at scale, with the highest environmental integrity. SAF uptake has grown over the last few years due to a combination of policy incentives and voluntary investments from corporate customers and airlines alike. A continuation and acceleration of these levers will drive more innovation in technologies and business models that will help ensure airplanes can take to the sky without impacting the climate.

07.19.24

Center for Green Market Activation Participates in White House Convening to Boost Clean Manufacturing

By GMA

The Center for Green Market Activation, represented by CEO Kim Carnahan, participated in a July 19 event at the White House that marked a number of developments in industrial decarbonization, including a new partnership between RMI and GMA to help coordinate corporate action on low-emissions cement and concrete.

Together, GMA and RMI are establishing an initiative focused on facilitating the deployment of capital towards low-carbon cement and concrete to dramatically reduce embodied emissions in the built environment.

06.12.24

Center for Green Market Activation Announces Launch

By GMA

June 12, 2024 (Washington, DC) – Today, the Center for Green Market Activation (GMA) launched as a new non-profit dedicated to harnessing corporate net zero ambition in hard-to-decarbonize sectors and jump-starting new markets for green fuels and materials. GMA is building on models developed by the Sustainable Aviation Buyers Alliance (SABA), a joint initiative of RMI and the Environmental Defense Fund (EDF), and the Zero Emission Maritime Buyers Alliance (ZEMBA), run by the Aspen Institute. Working closely with those key partners as well as the Smart Freight Centre and many others, GMA will engage companies willing to pay a premium for decarbonized goods and services and aggregate their demand to catalyze the adoption of low-carbon technologies within the hardest to decarbonize industries. Through GMA, companies seeking to reduce their suppliers’ emissions have an accessible, high integrity pathway to direct low-carbon investment deep within their value chain where it is needed most.

“GMA is scaling a proven model for raising critical capital in service of deep decarbonization in high emitting sectors, including aviation, trucking, concrete, and chemicals,” said Kim Carnahan, CEO of the Center for Green Market Activation. “Other organizations have successfully driven companies to set ambitious climate targets. GMA’s focus is turning those targets into bankable contracts.”

A US-based nonprofit organization, GMA received inaugural funding from the Bezos Earth Fund, and its programs are supported by grants from several other organizations. It focuses on high emitting sectors of the economy where decarbonization is particularly challenging due to the current high cost and limited availability of alternatives, and where the current pace of change is far from sufficient to reach climate goals. These critical, carbon-intensive sectors will require deployment of new technologies and significant capital to decarbonize, as well as strong demand signals to encourage commercial scale production. GMA’s programs are specifically designed to enable scalability at speed.

“The GMA team has been essential to ZEMBA’s success, from their technical expertise on alternative fuels and book-and-claim to their vision for widespread impact,” said Ingrid Irigoyen, CEO of ZEMBA and Senior Director, Ocean and Climate for the Aspen Institute. “We are eager to continue our collaboration and build on our great work together so far.”

GMA is an organization that enables broad cross-sector innovation, financing, and climate action by member companies through engagement with multiple sector-specific programs under a single umbrella. It leverages common infrastructure and the GMA team’s unique experience partnering with leading environmental non-profits and standard-setting organizations to design and stand up systems that channel funding towards high-quality, game-changing green technologies. Through participation in collective procurement programs for physical goods or environmental attribute certificates (EACs), members can address their Scope 3 emissions while benefiting from the quality assurance and economies of scale offered by GMA. GMA also supports suppliers of decarbonized goods and services by aggregating demand that represents a new, secure revenue stream.

“RMI has found that strong aggregated demand signals are critical to shifting and shaping the market for much needed low carbon solutions within the transportation and heavy industries sectors,” said Bryan Fisher, Managing Director of RMI. “The radical collaboration that we’ve been facilitating through demand platforms like SABA is critical to spark the investment needed for new technology and infrastructure deployment in these yet-to-decarbonize sectors. We look forward to deepening our work with GMA to further activate and organize demand.”

The GMA team has served as the Secretariat of SABA since its inception in 2021 and as strategic and technical advisors to the ZEMBA team throughout the process of designing its first tender. In addition to maintaining those roles, GMA will run programs for heavy duty trucking, cement and concrete, and chemicals, with plans to expand to other sectors in the future. A collective procurement for zero emission trucking is expected to be issued later this year. GMA ensures that all procurement it supports meets rigorous environmental standards, including third party verification.

“To decarbonize today’s economy – especially in challenging sectors such as aviation and maritime shipping – we need to rapidly ramp up funding for solutions with the greatest environmental integrity,” said Angela Churie Kallhauge, Executive Vice President for Impact at EDF. “Organizations like GMA, working with trusted partners like EDF, are instrumental to shaping the markets for green fuels, safeguarding against greenwashing, and ensuring that new technologies genuinely benefit both people and the planet.”

In addition to CEO Kim Carnahan, GMA’s leadership team includes Ellen Palmer as Chief Finance & Operations Officer, Andre de Fontaine as Senior Director of Programs, and Kari Pederson as Chief of Staff and Senior Advisor.

“To spur new green markets, we need a new breed of climate action focused on deployment,” said Christoph Wolff, CEO of Smart Freight Centre. “Leveraging the Smart Freight Centre’s normative accounting framework and close partnership with global shippers active in decarbonizing their logistics, we are excited to partner with GMA to jointly aggregate shipper demand for the environmental attributes of zero-emission trucks and therefore accelerate the deployment of zero-emission trucks.”

GMA’s work will leverage the efforts of the Advanced and Indirect Mitigation (AIM) Platform, a partnership with C2ES and Gold Standard focused on developing a standard and guidance for accounting, claiming, and reporting the impacts of value chain interventions towards corporate climate targets. The AIM Platform’s draft criteria is currently out for public comment and can be accessed at AIMPlatform.org.

Companies interested in becoming members or joining any of GMA’s sector initiatives are encouraged to visit www.gmacenter.org or email info@gmacenter.org.

About Center for Green Market Activation

The Center for Green Market Activation (GMA) is a US-based, globally focused non-profit. Through innovative book and claim systems, new and creative procurement approaches, and demand aggregating buyers’ alliances, GMA catalyzes and scales the uptake of low-carbon goods and services within carbon intensive industries such as aviation, maritime, trucking, cement and concrete, and chemicals. With collective decades of experience in environmental markets and alternative fuels and materials, GMA works to standardize new, green markets and forges mutually beneficial partnerships between climate-focused companies, suppliers, and mission-aligned non-profit organizations to channel funding to critical climate technologies in pursuit of accelerated sectoral decarbonization. For more information, please visit gmacenter.org.

Media inquiries should be directed to pr@gmacenter.org.