06.17.25

GMA Newsletter – Summer 2025

See below for the online version of GMA’s Summer 2025 newsletter. To receive future editions directly to your inbox, sign up through the form at the bottom of our homepage or email pr@gmacenter.org to be added to our mailing list.

A message from Kim

Kim Carnahan, GMA CEO

As summer begins, I’m reflecting on GMA’s first full year. It’s safe to say we came out swinging – we’ve launched new programs, grown existing initiatives, set and met ambitious milestones, and expanded our staff from 4 to 24 (!!!) to support this important work. The slideshow video linked above summarizes the highlights – please check it out!

As we look ahead to year two, our momentum continues to accelerate. I’m relieved (seriously) to share that GMA has officially been granted 501(c)3 status, bolstering our ability to fulfill our mission effectively. At the midway point of a tumultuous 2025, we’re also encouraged by strong signals from SBTi that it sees the crucial role indirect mitigation plays in overcoming barriers to addressing value chain emissions.

We’re excited to engage in the expert working group they set up to support their Corporate Net-Zero Standard revision process, as well as similar expert groups under the GHG Protocol revision process. Standard setting can be grueling work but it’s critical to create the right incentives and guardrails for climate action.

To support these efforts, we’re also digging in and sharing our deep technical expertise on the complex mechanics of market-based value chain decarbonization through our GMA Insights series (keep scrolling to find links to our latest publications below and really nerd out).

We are confident that the book and claim systems we design with our partners will meet any guardrails SBTi may put in place, and we are doubling down on our joint procurement efforts to ensure companies have avenues to meet their ambitious SBTs. We are currently reviewing bids from our first GMA Trucking pilot procurement and have been blown away by the number and quality of the bids, as well as the enthusiasm and commitment of the carriers. There are some truly game-changing companies in the mix. If you’re not a member of GMA Trucking yet and are interested in decarbonizing your on-road freight, please get in touch! There is still time to join this first-of-kind procurement.

While I couldn’t be prouder of our accomplishments in year one, we recognize it’s still an uphill battle. Luckily, I love running hills! See you all soon, hopefully in real life. Until then, keep up the good fight.

Program Updates

Aviation

Our work with the Sustainable Aviation Buyers Alliance (SABA) reached important milestones, including the launch of two procurement tracks designed to encourage near and long-term investment into sustainable aviation fuel (SAF). SABA’s next-generation SAF procurement is aimed at helping move a next-generation SAF plant to final investment decision, while SAFc Connect is a first-of-its-kind platform to connect buyers with high integrity SAFc volumes that are available now. Notable updates within the recently published revision of SABA’s Sustainability Framework for SAF include the addition of SABA-eligible SAF registries and how fuels can meet the “SABA Advanced” criteria.

Trucking

The GMA Trucking pilot RFP response period closed at the end of April and the evaluation and shortlisting process will culminate with winner selection later this summer. Due to larger than anticipated bid volumes, GMA Trucking is opening up additional purchase opportunities for zero emission trucking service attributes. Email trucking@gmacenter.org to learn more.

Cement & Concrete

Alongside program partner RMI, we continue our work on book and claim system design, with subgroups of the Working Group exploring key design elements such as accounting and baselining in greater depth. Most recently, the Working Group aligned on a multi-functional unit system that would allow for investment in low-carbon clinker, cement or concrete solutions within a common framework and registry. The demand aggregation phase of our work is planned for launch in early fall with the formation of a buyers alliance focused on low-carbon cement and concrete. Email concrete@gmacenter.org to learn more.

Chemicals

Chemicals program design continues under the new leadership of Andrew Alcorta, who joined the GMA team in May. Watch this video narrated by team member Ash Khetpal to learn more about the program’s focus and intent, which in the near term will support the launch of an early stage pilot procurement for low emission plastics and fertilizers.

Sound interesting? Reach out to chemicals@gmacenter.org to explore participation in our soon to launch, early stage pilot!

AIM Platform

The AIM Platform Association Test pilot came to a successful conclusion, and feedback from diverse stakeholders will inform updates currently underway. The Association Test is intended to aid corporates in identifying which decarbonization investments can be credibly associated with their value chains. Next in the AIM Standard and Guidance development process is the release of the draft Quality, Reporting, and Accounting (QAR) Requirements. A pilot and stakeholder comment period for the QAR will launch later this summer and will be followed by a revision process. Together, the Association Test and QAR Requirements will make up the full Standard and Guidance, which will be considered by the AIM Standard Governing Committee for approval and publication in Q4 2025.

Maritime

The Zero Emission Maritime Buyers Alliance (ZEMBA) and Katalist recently published an open letter with 13 signatories in reaction to SBTi’s recent revision of the Corporate Net-Zero Standard and Guidance. The letter focuses on the importance of indirect mitigation efforts in facilitating the clean energy transition for maritime, following the themes established in the group’s engagement with SBTi’s public consultation period. The RFP response period for ZEMBA’s e-fuel-focused second tender closed in April with results expected to be announced by end of 2025.

In the News

- SABA’s SAFc Connect was featured in Trellis: $30 million spend expected at new sustainable aviation platform

- Energy Institute | New Energy World covered the release of SABA’s next-gen RFP: US scales up SAF with major developments

- Our cement & concrete work in partnership with RMI was highlighted in recent announcements about Microsoft’s collaboration with Sublime to decarbonize its construction operations.

#ICYMI

- Don’t miss our latest GMA Insights:

- Watch our newest explainer video focused on book and claim for zero emission trucking and our work in strategic partnership with Smart Freight Centre.

- Listen to the SAF Investor podcast for a conversation with Andre de Fontaine discussing SABA and SABA’s 2025 procurements.

- Learn more about pathways to sustainable flight – SABA’s May webinar is viewable on demand.

Upcoming Events

California Global Hydrogen Energy Transition Summit

June 30-July 1 | Sacramento, CA

Edmond Yi is participating in the session, “H2 Certification – Standardizing Green-e and International Certification of Clean/Renewable H2”

GMA is a Supporting Sponsor of this event.

Argus North Americas Biofuels, LCFS & Carbon Markets Summit

September 15-17 | Monterey, CA

Edmond Yi is an invited speaker for this event.

Climate Week NYC 2025

September 21-28, 2025 | NYC

GMA representatives will be participating in a diverse agenda of convenings and discussions. Stay tuned for details on the week’s events, including the second annual Green Markets Day.

SAF North America Congress 2025

October 14-16, 2025 | Houston

GMA will be joined by SABA stakeholders for sessions focused on corporate action in the SAF market.

VERGE hosted at Trellis Impact 2025

October 28-30, 2025 | San Jose

GMA representatives will participate in multiple panels throughout the conference. Stay tuned for more!

06.03.25

GMA Insights | Why System Boundaries Matter: Exploring Various Market-based Approaches to Deep Value Chain Decarbonization

INTRODUCTION

Welcome back to GMA Insights, a series where we explore concepts related to high-integrity market-based value chain decarbonization. In the first installment of the series, we introduced the concept of chain of custody models and explained “book and claim” – the model used most often by GMA – in greater detail.

But why do different chain of custody models exist? Is one “better” than another? In short, which model is “best” will depend on the situation, and on the goals of the company applying the model. Each model follows a unique methodology and has its own set of rules. Some are focused on detailed tracking of physical products within a system. Others focus more on tracking the characteristics inherent in a set of products or materials, whether or not these characteristics keep their 1:1 attachment to physical products within that system.

Today, we’ll do a deeper dive into two different chain of custody models: book and claim and mass balance. We’ll explain how each of them works and the rules that must be followed within each model. Given that companies can – and do – use both of these models to track the impact of their decarbonization efforts, we’ll explore why one might be preferable to another, depending on which goals an organization is trying to achieve.

So let’s get to it, starting with some fundamentals about both the book and claim and mass balance models.

MASS BALANCE CHAIN OF CUSTODY MODEL

A mass balance chain of custody model allows for physical mixing of materials with specified characteristics with other materials that do not have those characteristics. Despite this physical mixing, in a mass balance model the materials with specified characteristics are tracked as they move through a process or distribution system. The total amount of materials that are documented entering the process or system must match (taking into account process or system losses) the amount of materials that are documented coming out of the process or system.

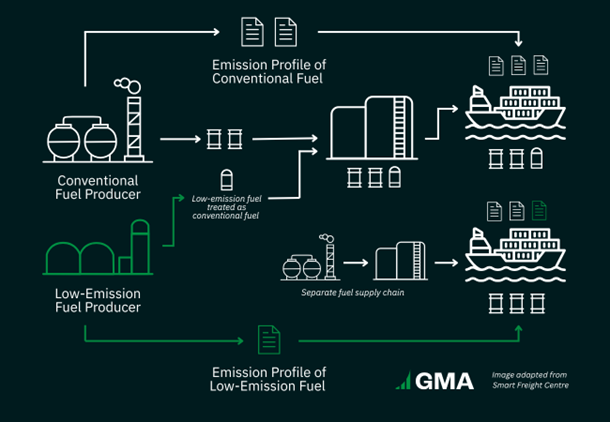

For example, in a fuel distribution network a low emission fuel may be mixed with a fossil fuel that does not have a low emission profile. If a mass balance model is employed, at each phase in the fuel distribution network, the amount of low emission fuel and the amount of fossil fuel is tracked and documented. That is, the distribution network managers would know that, of X gallons of fuel in a storage facility in the network, Y gallons are theoretically low emission fuel and Z gallons are theoretically fossil fuel. The number of low emission fuel attributes assigned to fuel withdrawn from the fuel distribution network must match the number of gallons of low emission fuel that was added to the network. See Figure 1.

Figure 1: A mass balance chain of custody model.

BOOK AND CLAIM CHAIN OF CUSTODY MODEL

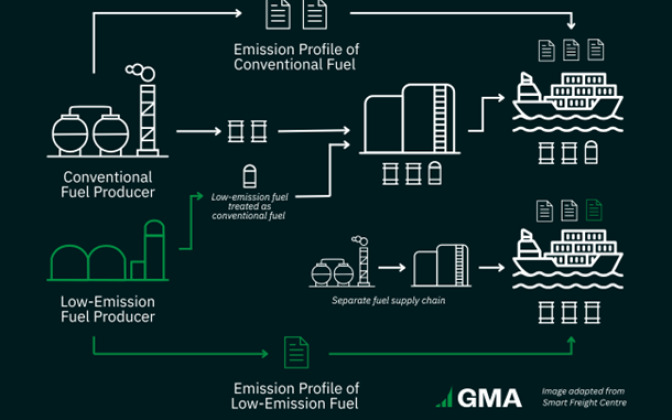

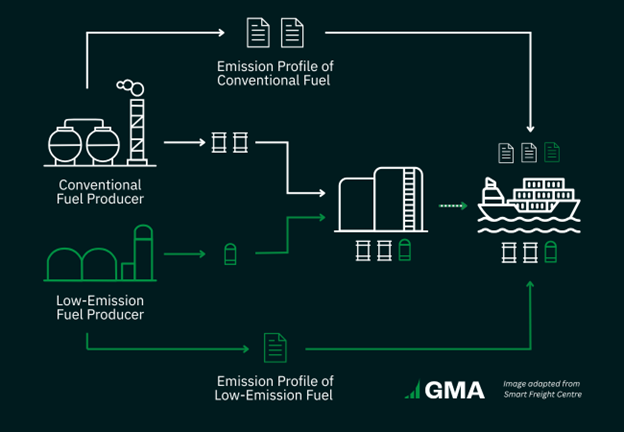

A book and claim chain of custody model also allows for physical mixing of materials with specified characteristics with other materials that do not contain those characteristics. In a book and claim model, though, the amount of materials with specified characteristics does not need to be tracked and documented at each step of the process or distribution system. Instead, the characteristics of the inputs are completely decoupled from the physical materials at or before the point of mixing. These characteristics are then tracked separately from the flow of the physical material. The materials’ characteristics are recorded and transferred in a documentation system (e.g., a registry) to ensure the integrity of accounting for these characteristics.

Applying these ideas to our example from above, a low emission fuel may still be mixed with a fossil fuel that does not have a low emission profile. But under the book and claim model, the low emission fuel’s emission attributes are completely separated from the fuel before or at the point of mixing. Once the low emission fuel and fossil fuels are mixed, the combined physical fuel is treated as if it had no low emission characteristics. The attributes of the low emission fuel are tracked and transacted independent of the physical fuel product. See Figure 2.

Figure 2: A book and claim chain of custody model.

Program spotlight: The Sustainable Aviation Buyers’ Alliance (SABA), a program that GMA runs in partnership with Environmental Defense Fund and RMI, relies on the book and claim model. Sustainable aviation fuel (SAF) is mixed with conventional jet fuel, with the physical mix of SAF and conventional jet fuel distributed and sold as though it were all conventional jet fuel. The low emission attributes of the SAF are completely separated from the physical SAF and transacted by means of SAF certificates in the SAFc registry.

THE IMPORTANCE OF SYSTEM BOUNDARIES

A chain of custody model’s boundary, in general terms, establishes where a company draws the line to ensure that products and characteristics going into a system (e.g. a manufacturing or refining process) match those emerging at the end. It may be surprising to see how much this decision can impact how companies can assign characteristics to their products.

Let’s explore this idea by imagining a bustling metropolis that’s home to many companies that specialize in baking wheat into delicious loaves of bread.

Company 1: Mass Balance with a Bakery Level System Boundary

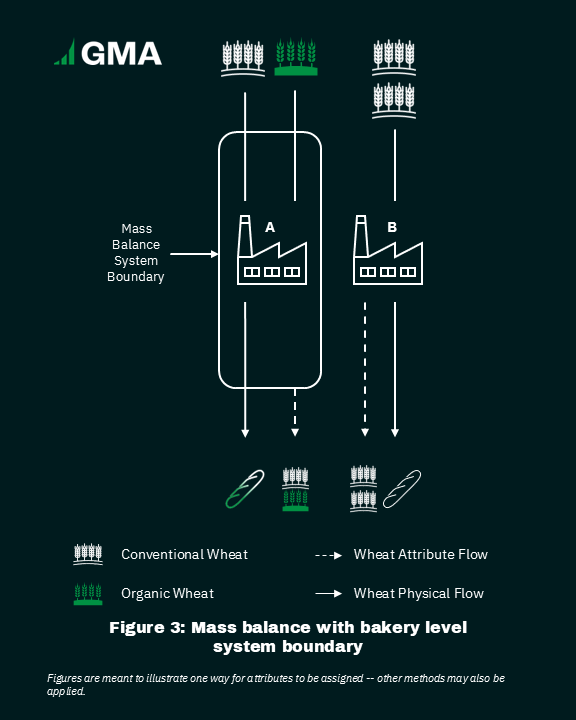

Company 1 operates two bakeries: Bakery A and Bakery B.

Bakery A receives both conventional wheat and organic wheat from its wheat suppliers. The conventional wheat and organic wheat are mixed together at the bakery and made into bread.

Bakery B does not use any organic wheat to make bread.

The company applies a mass balance chain of custody model to attribute wheat characteristics to loaves of bread, and sets the model boundary at the bakery level. See Figure 3 below.

While Company 1 cannot be sure that every single loaf of bread baked at Bakery A contains organic wheat, the company does know that over a certain period of time, the wheat in the loaves of bread (in totality) baked at Bakery A was 50% organic wheat.

In this example, the system boundary (i.e., Bakery A) matches the boundary for material (i.e., wheat) flows. A buyer sourcing all of the bread from Bakery A would receive, over the period of time during which Bakery A conducted its mass balance[1], bread that physically contained 50% organic wheat.

Company 2: Mass Balance with a Company Level System Boundary

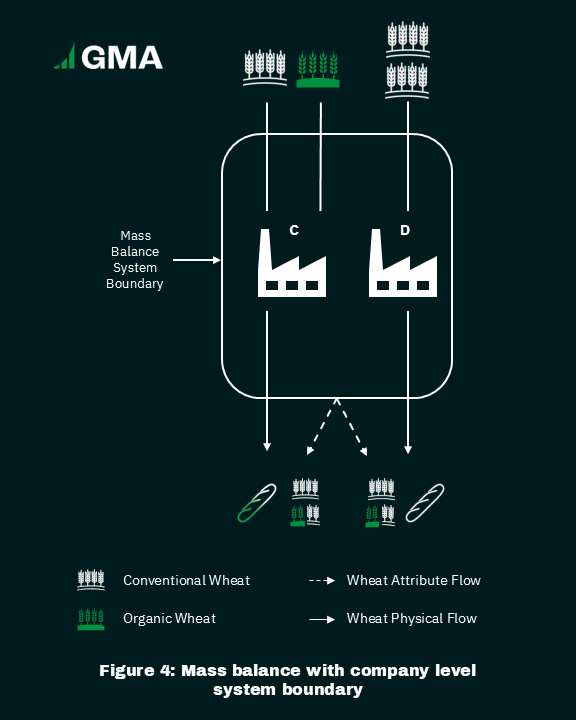

Company 2 also operates two bakeries: Bakery C and Bakery D. The inputs for the two bakeries are the same as they were in the previous example, but the system boundary is drawn in a different place.

Bakery C receives 50% conventional wheat and 50% organic wheat from its wheat suppliers. The conventional wheat and organic wheat are mixed together at the bakery and made into bread.

Bakery D does not use any organic wheat to make bread.

The company applies a mass balance chain of custody model to attributing wheat characteristics to loaves of bread, and sets the model boundary at the company level. See Figure 4 as follows.

Unlike Company 1, Company 2 has set its mass balance system boundary at the company level. As such, Company 2 may attribute the characteristic of “organic wheat” to bread that has no chance of physically containing organic wheat (i.e., bread from Bakery D).

In this example, the system boundary (i.e., the company) does not match the boundary for material (i.e., wheat) flows. The amount of organic wheat attributed to the bread that buyers are purchasing is no longer linked to the amount of organic wheat that is physically in the bread that they receive.

Companies 3 and 4: Book and Claim with a Sector Level System Boundary

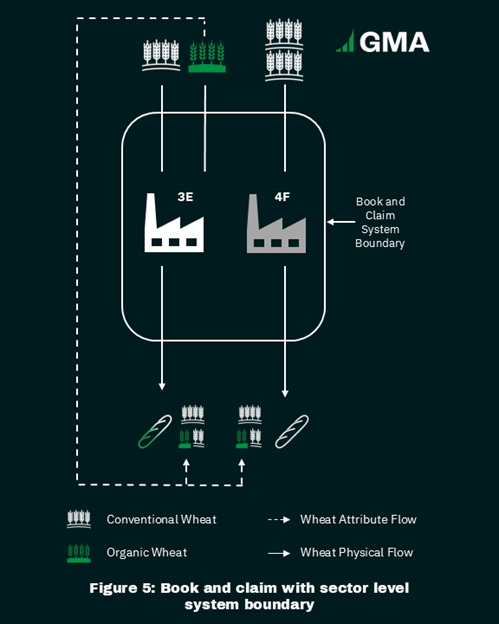

Our next two companies each operate one bakery: Company 3 operates Bakery E, and Company 4 operates Bakery F. For the purposes of this example, together these two companies make up the bread sector.

Bakery E receives both conventional wheat and organic wheat from its wheat suppliers. The conventional wheat and organic wheat are mixed together at the bakery and made into bread.

Bakery F does not use any organic wheat. See Figure 5, below.

Company 3 applies a book and claim chain of custody model to attributing wheat characteristics to loaves of bread. Although some organic wheat is in the bread from Bakery E, Company 3 does not trace this wheat. Instead, Company 3 separates the organic attributes from the organic wheat before that organic wheat is mixed with conventional wheat at Bakery E. Company 3 then sells the attributes of that organic wheat to both companies buying bread from its own bakery – Bakery E – as well as to companies buying bread from a different company – Company 4 – which makes bread at Bakery F.

Now, take a look back at Figure 4 and compare it to Figure 5. Even though Company 2 applied a mass balance model and Company 3 applied a book and claim model, in both cases organic wheat characteristics are attributed to loaves of bread that have no chance of physically containing any organic wheat.

CONCLUSION

So is one chain of custody model “better” than another? Does one do a more accurate job of tracking and measuring special characteristics of physical products and giving customers a way to buy materials that “have” those characteristics? Is one model better than another at helping companies achieve their decarbonization goals?

Well, it depends. As we saw in the bakery examples above, the system boundary can have just as big an influence as the chain of custody model on the link – or lack of a link – between the characteristics and the physical composition of a batch of products.

What does this mean for decarbonizing heavy industry? Well, if you buy steel that has been attributed low emission characteristics through a mass balance model, that doesn’t necessarily mean that you will physically receive any low emission steel. The physical steel you receive might be low emission steel… but it also might not be. It depends.

Because the mass balance model maintains a closer tie between physical products and their special characteristics, some people think that the mass balance model is inherently more accurate than book and claim. As we see it, the value of an approach lies in its ability to achieve objectives. If a company’s objective is to support the decarbonization of its physical steel suppliers (meaning, at minimum, it knows who they are and that they are likely to remain the same), then a mass balance approach with a company-wide system boundary will work fine.

If a company has any other objective – for example, if its supply chain isn’t as straightforward as the examples above, then the book and claim model becomes indispensable.

Some may also think that mass balance approaches are inherently more credible than book and claim. The issue of credibility in chain of custody systems will be explored in a future edition of GMA Insights.

[1] Provided that there is not crediting of attributes across mass balancing periods (i.e., the amount of time during which the mass balance is calculated). If Company 1 credited organic wheat attributes across mass balancing periods, there is the possibility that no loaves of bread from one period would contain organic wheat, and that those loaves of bread could be attributed the characteristics of organic wheat from a previous period. For more details on crediting across balancing period, see ISO Standard 22095.

05.23.25

Early Results from GMA’s First Trucking RFP Signal Robust Market for Heavy-duty, Zero-emission Vehicles (ZEVs)

The (preliminary) results are in.

Since launching in 2023, GMA Trucking continues to make major strides in activating the market for zero-emission road freight. The response period for our pilot procurement for zero-emission trucking attributes recently closed, and we’re excited to share that the overall response from carriers has exceeded our expectations.

By the numbers:

With 36 distinct bids from 9 different U.S. carriers, the pilot RFP received more bid volume than our initial expectation, with nearly 900,000,000 annual ton-miles from 760 zero-emission trucks, equivalent to about 145,000 tonnes CO2e abated annually. This demonstrates that carriers, working with OEMs and charging companies, are ready to provide zero emission trucking services when incentivized by appropriate demand signals and market flexibility.

Bids for “net-new” vehicles – defined as vehicles not currently in operation that would be deployed to meet the GMA Trucking RFP demand – made up 69% of bids and comprised 97% of the annual ton-mile volume.

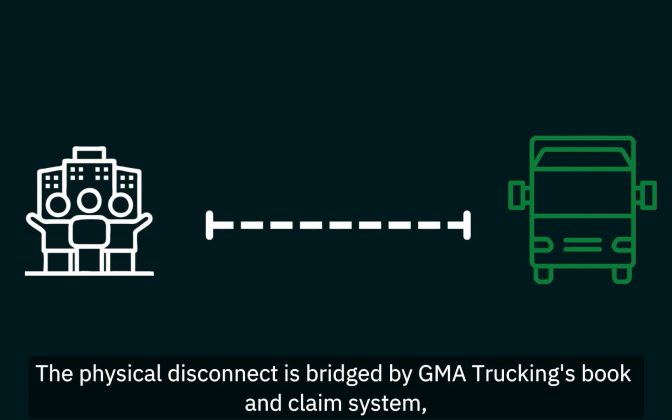

The RFP received bids from 14 states, with bid volumes equally split between California and non-California bids. This geographic diversity, combined with more flexibility in shipping routes, demonstrates the positive influence that a book and claim mechanism can have in spreading zero emission trucking beyond states with more favorable policy incentives and existing charging infrastructure. By engaging with our approach, carriers are able to deploy where it makes the most sense, lowering their overall ZEV operating costs and increasing the emission reduction impact.

What’s next:

The GMA Trucking team has begun the bid evaluation process. We plan to arrive at a shortlist by early June, followed by final selection and contracting. Attributes from these zero emission trucking routes could begin flowing as early as 2026.

While deeper analysis is ongoing, our initial review of responses reveals a strong and consistent message: both the buyer and seller sides of the market are ready for zero-emission trucks. By combining the aggregated demand of our climate-ambitious members with a high integrity book and claim approach, GMA Trucking, alongside strategic partner Smart Freight Centre, is helping accelerate the transition to net-zero heavy duty trucking. We look forward to announcing the pilot RFP winners later this year.

This RFP represents just the first of many planned future procurements. The GMA Trucking program is growing, and we continue to welcome new organizations as members of the buyers alliance. To explore GMA Trucking membership and gain access to current and future purchase opportunities for zero emission trucking service attributes, email trucking@gmacenter.org.

To learn more about GMA Trucking and how we work, see our recent explainer video:

04.29.25

Insights from the AIM Platform on Deep Value Chain Analysis

Today we’re excited to feature the thought leadership of the AIM Platform with a repost of their latest exploration of deep value chain analysis. This approach draws upon a number of methods to allow companies visibility deep into their value chains – beyond the products they directly purchase – to better understand the GHG emissions associated with their suppliers and those suppliers’ suppliers and identify common emission sources. The resulting insights can help companies prioritize and scale corporate decarbonization investments where they can have the greatest beneficial impact.

The AIM Platform is an initiative developed in collaboration with GMA, C2ES and Gold Standard, with a mission to unlock vast new sums of private climate finance by bringing civil society and the private sector together to remove roadblocks to value chain mitigation and ignite sectoral transition. We encourage you to learn more on the AIM Platform website and engage with their ongoing work developing the AIM Standard and Guidance which is targeted for release in late 2025.

Summary

Scope 3 emissions represent a significant percentage of many companies’ greenhouse gas inventories. But using traditional methods to calculate scope 3 does not actually give companies insight into the biggest impacts in their supply chain. Deep Value Chain Analysis can help companies identify and quantify emissions sources that were previously hidden deep within their supply chains. Using these insights, companies can “match” their scope 3 emissions with effective interventions that can be implemented today, leveraging their purchasing power for maximum impact.

Introduction

Scope 3 emissions represent a significant percentage of many companies’ greenhouse gas inventories. As a result, companies spend a lot of time and effort quantifying these emissions with the goal of figuring out effective ways to reduce them. For many companies, identifying how to reduce scope 3 emissions is a critical part of their overall greenhouse gas reduction strategy.

Unfortunately, when a company uses traditional methods for calculating its scope 3 impact, the resulting data may not actually help them identify the largest drivers of their scope 3 emissions. Nested within a company’s scope 3 numbers are many layers (or tiers) of supply chain activities. This means that although a company might have calculated a perfectly “accurate” scope 3 inventory, that data tells them very little about how they can mitigate those emissions.

Luckily, methods do exist that help companies “see” the critical emission sources that are hidden within their scope 3 data. Identifying and quantifying these emissions sources means companies can match them with impactful interventions. We refer to these methods, collectively, as Deep Value Chain Analysis.

What is Deep Value Chain Analysis?

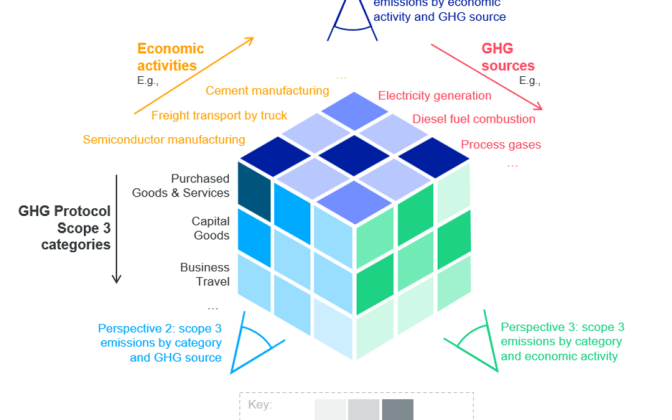

Deep Value Chain Analysis, sometimes referred to as horizontal LCA analysis, uses input-output data to estimate the quantity of emissions from various upstream materials and processes that are required to produce the products and services that a company purchases. Input-output tables are developed by government agencies for economic assessment and indicators, and environmentally-extended input-output (EEIO) data are commonly used to calculate parts of company scope 3 inventories.

Rather than relying on emission factor data that adds up all emissions that go into producing a given product and then uses that information to assign a single emission factor to that product, Deep Value Chain Analysis identifies the upstream processes (electricity generation, product transportation, different manufacturing processes, etc.) that went into making that product. This analysis is then repeated for products and services across a company’s value chain. Value chain totals for each type of intermediary emissions are then aggregated. This allows the company to identify which processes show up most frequently across its value chain and prioritize mitigation efforts that lower emissions for these specific processes. This allows companies to prioritize decarbonization opportunities that address the biggest drivers of emissions across their value chain, which maximizes the impact of their decarbonization work.

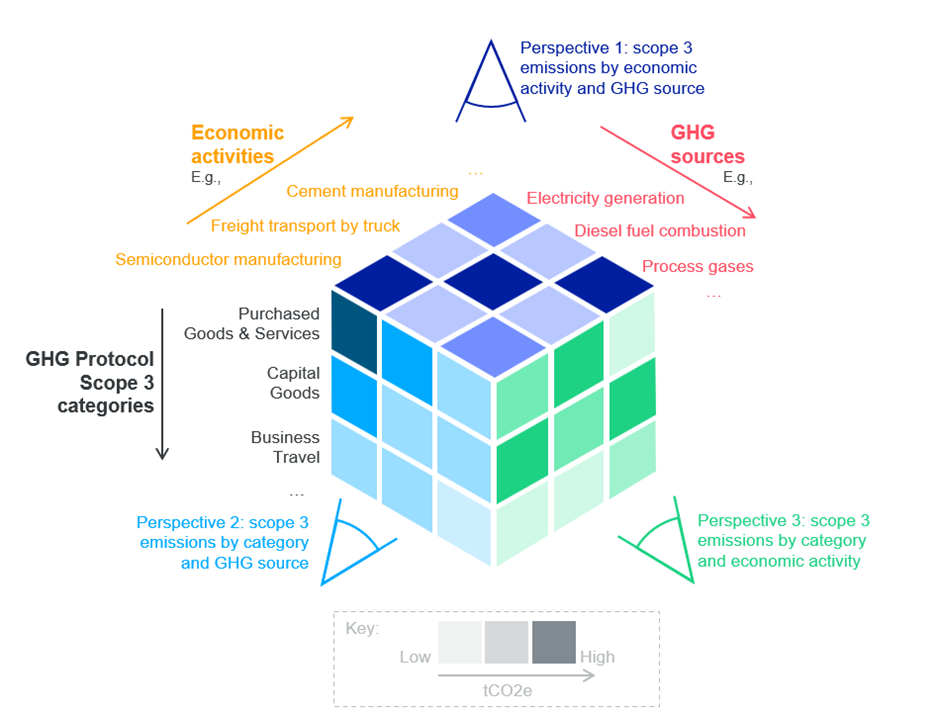

Figure 1. Emission drivers visible through Deep Value Chain Analysis

Image source: A Systematic Approach to Identifying Scope 3 Emissions (2022). Engie Impact

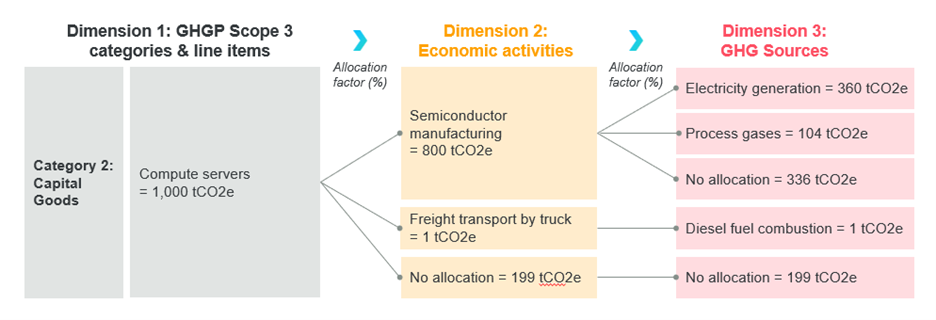

For example, a company might purchase a piece of electronic equipment. In order to manufacture that product, several specific economic activities – manufacturing, transport, etc. – would have taken place. Each of these activities results in GHG emissions. Once this level of detail has been identified within an organization’s supply chain, it is possible to assess the activities driving those emissions, such as electricity generation, diesel fuel combustion, industrial process emissions, etc. Once these actionable sources have been identified, it’s possible for companies to use their purchasing power to increase deployment of industrial decarbonization technologies specific to those sources. In other words, using Deep Value Chain Analysis, a vague scope 3 line item in a company’s inventory can be translated into a set of concrete emissions sources that the company can work to mitigate.

Figure 2. Breaking down electronic equipment emission drivers

Image source: A Systematic Approach to Identifying Scope 3 Emissions (2022). Engie Impact

Benefits of Deep Value Chain Analysis

Companies, researchers, and solutions providers are starting to deploy Deep Value Chain Analysis as a way to develop scope 3 reduction strategies that have a measurable impact on specific emissions sources within companies’ supply chains.

For example, Meta worked with Engie Impact to develop a framework that translates scope 3 data into detailed greenhouse gas emission sources that can be addressed through investment in specific emission reduction projects. This framework has allowed Meta to work with value chain partners to leverage effective, direct emissions reduction strategies traditionally only possible when addressing scope 1 and scope 2 emissions.

Deep Value Chain Analysis in the AIM Platform Association Test

The draft AIM Platform Association Test recommends that companies use Deep Value Chain Analysis methods in two related ways:

- 1.To identify products they may not purchase directly but which are produced deep within their value chains, and

- 2.To aggregate their demand for decarbonization solutions across like products.

Leveraging Deep Value Chain Analysis in these ways will yield detailed information about the specific economic activities and related emissions sources that underpin each company’s value chain. These insights will allow companies to prioritize their participation and investment in buyer alliances such as those GMA and partners manage for chemicals, trucking, and cement & concrete, secure in the knowledge that their actions mitigate emissions sources foundational to their own scope 3 inventory emissions.

Next Steps

Today, more than 20 companies are testing Deep Value Chain Analysis and other methods to identify inventory emission sources, with the ultimate goal of matching these sources with impactful value chain interventions. Early results point to Deep Value Chain Analysis – and the detailed data it reveals – as an important unlock for significantly more effective corporate scope 3 mitigation at scale.

____________

Interested in trying out Deep Value Chain Analysis yourself? Check out these resources:

02.25.25

Introducing the GMA Insights Informational Series | Chain of Custody Models

by Dan Smith

Introducing GMA Insights

We are excited to launch GMA Insights, an informational series that will delve into important topics surrounding market-based approaches to value chain decarbonization. GMA’s mission to activate new markets for low-carbon fuels and materials is clear, but complex in practice. As we develop and operationalize robust approaches and systems to achieve this mission, many of the considerations informing our work warrant deeper explanation.

GMA Insights will be a forum to explore those topics. Our aim is to bring clarity and transparency to the principles, tools, and techniques that we apply to activating new markets.

GMA works on the leading edge of value chain decarbonization, which means that we are often in uncharted territory. Some concepts that we explore through GMA Insights may be evolving even as we discuss them. We welcome reflections from the climate community on these topics. If you have thoughts about an insights article, or ideas for a topic that you want us to explore, please reach out at info@gmacenter.org.

Chain of Custody Models

Our first GMA Insights topic will address a fundamental set of tools that GMA applies to our decarbonization programs: chain of custody models. A chain of custody model is defined as an approach to tracking and documenting inputs and outputs of materials through a process or distribution network[1].

Chain of custody models are applied to products that people use and consume every day. Have you bought a piece of fruit that is labeled USDA Organic? A chain of custody model and requirements were applied to maintain appropriate separation of that fruit from non-organic fruit. Have you seen the MSC label on fish or other seafood? Same thing. Have you noticed the FSC Certified stamp on a greeting card or cardboard box? The wood that went into those paper products was tracked – you guessed it – according to a chain of custody model.

There are five general chain of custody models:

- Identity preserved

- Segregated

- Controlled blend

- Mass balance

- Book and claim

Book and Claim Models

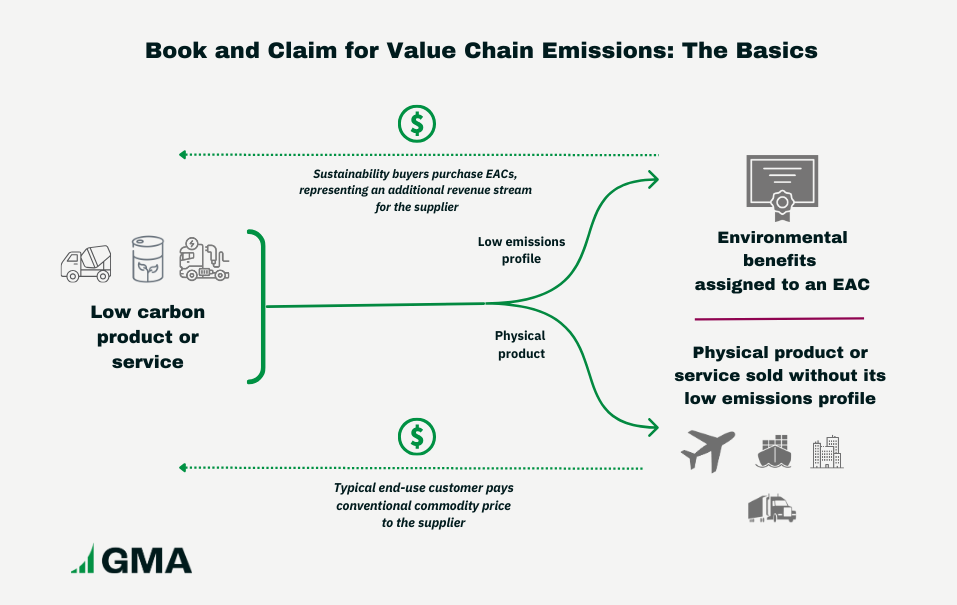

Most of the programs that GMA and our partners manage rely on the book and claim model. In a book and claim model, the characteristics (within GMA’s work, the low greenhouse gas emission profile) of a product or service are separated from the product or service itself. These characteristics are assigned to Environmental Attribute Certificates (EACs), which are “booked” in a tracking system such as a registry. The physical product or service itself is then treated as though it were a normal product or service without its low emission characteristics.

A company that is committed to reducing its value chain emissions for the product or service associated with the EAC could buy and “claim,” EACs representing low emission products and services. Purchasing EACs enables the company to support decarbonized products and services, even if the company could not buy the decarbonized products or services in its physical supply chain. See Figure 1. (We will explore additional facets of book and claim and its benefits in a later entry.)

Figure 1

Figure 1

Making Informed Decisions

For organizations considering the use of book and claim systems to decarbonize their value chains, there are many factors to be aware of when assessing whether a system is robust and transparent. That makes it important for organizations to educate themselves about chain of custody models, their benefits, and their limitations.

A core part of GMA’s work is to develop high integrity book and claim systems that support our decarbonization programs. We’ve learned a lot about chains of custody through this work and are happy to share from our experience. The GMA Insights series offers a way for us to explain features of book and claim and other chain of custody models and the implications of their use, with an aim to foster transparency and informed decision-making by organizations purchasing products based on the models.

The next GMA Insight, in which we take a close look at key differences and similarities between book and claim and mass balance models, and the importance of system boundaries for those models, will be published in coming weeks.

[1] Readers interested in detailed definitions of chain of custody models can review ISO Standard 22095:2020, and keep an eye out for the forthcoming ISO Standards 13662 and 13659. We’ve also found National Institute of Standards and Technology’s Publication 1500-206 to be a helpful primer on chain of custody models.

01.24.25

Globe and Mail Profiles Buyers Alliances, Highlights Their Role Driving Investment into Low and Zero-carbon Fuels

A recent article published by Toronto’s The Globe and Mail highlighted the groundbreaking work of GMA and our partners in standing up buyers alliances and running collective procurements to help decarbonize hard to abate heavy transport and industrial sectors. Innovation reporter Pippa Norman focused in particular on the Zero Emission Maritime Buyers Alliance (ZEMBA), for whom GMA provides technical support, and the Sustainable Aviation Buyers Alliance (SABA), of which GMA is Secretariat. Both alliances have effectively engaged with climate-ambitious global brands to channel new investment to sustainable fuels, starting with SABA’s first-of-kind procurement for sustainable aviation fuel certificates in 2023.

A key takeaway from the article: emissions from sectors like aviation and maritime are not on track to meet 2050 net zero goals, and buyers alliances have an important role in pooling demand to create a clear market signal, connecting shippers and air travelers with nascent low and zero carbon alternatives, and helping accelerate the transition away from carbon intensive fuels.

GMA CEO Kim Carnahan was among the sources quoted in the article, including the following excerpt:

Kim Carnahan, the president and CEO of the Center for Green Market Activation, which works with and operates buyers’ alliances in five different sectors in partnership with non-governmental organizations, said the effectiveness of these groups is evident through the procurements that have been run by SABA, which she also helped found.

In its first procurement, she said, SABA had seven participants, requested 2.5 million gallons of sustainable aviation fuel but was only able to facilitate purchases for 850,000 gallons. In its second procurement, it had almost 20 participants, requested 100 million gallons and secured commitments for about 50 million. This year, she estimates, the alliance could hit $1-billion in total investment.

“It’s not enough. The overall aviation market needs vastly more investment. But having increases year on year that are as significant as those is certainly a sign of real progress and a sign that the initiatives we’re running work,” she said.

Ingrid Irigoyen, CEO of ZEMBA, described the process and benefits associated with the buyers alliance model as applied to the maritime sector:

“It’s a way of facilitating or enabling demand from all over the world, regardless of the physical freight flows of the company, aggregating that demand and channeling it into the available best deal solutions,” she said.

The full article is available here.

To learn more about how GMA and our partners are helping implement buyers alliances across a range of heavy transport and industrial sectors, or to explore membership, connect with us.

12.17.24

Global Brands Partner with GMA Trucking to Drive Faster Adoption of Zero-Emission Heavy-Duty Vehicles

Carriers invited to respond to first-ever joint procurement that seeks to deploy up to 250 zero-emission trucks

December 17, 2024 (Washington, D.C.) Today, the Center for Green Market Activation (GMA) in partnership with Smart Freight Centre announced the release of a request for proposal (RFP) for zero-emission trucking service attributes through its zero-emissions trucking program, GMA Trucking. The RFP targets the deployment of approximately 250 Class 8 battery electric or hydrogen fuel cell trucks representing up to 14 million miles traveled per year. For context, only 760 new Class 8 zero-emission trucks were put on US roads in 2023. This pilot initiative represents a first-of-its-kind procurement leveraging a book and claim system to scale adoption of zero-emission heavy-duty trucks and increase access to zero-emission trucking services for companies with ambitious climate targets. The RFP seeks to overcome utilization, infrastructure and market challenges associated with Class 8 zero-emission truck deployment by connecting US carriers with corporate customers ready to take meaningful action to address their road freight emissions.

Zero-emission trucks make up less than 1% of the new medium- and heavy-duty vehicles on the road today. Without demonstrated demand from the market, the trucking industry is likely to remain off track in reducing emissions at the rate needed to meet climate targets.

“This is a very clear, very loud demand signal for any carrier paying attention. Companies want zero-emission trucking services and are willing to make the investments needed to access them,” said Kim Carnahan, GMA CEO. “This pilot procurement is just the beginning. As with similar buys in aviation and maritime, we expect the second round to eclipse this one many times over.”

Launched in 2023, GMA Trucking works with pioneering trucking customers interested in advancing decarbonization within heavy-duty road transportation through a buyers alliance and book and claim model similar to that used by the Sustainable Aviation Buyers Alliance (SABA) and the Zero Emission Maritime Buyers Alliance (ZEMBA). Over the course of 2024, CarbonLeap, Etsy, Kuehne+Nagel, Netflix, Reckitt, and others have joined previously announced founding members eBay, Green Worldwide Shipping, Meta, PepsiCo, and REI Co-op. Procurement through GMA helps members achieve their “Scope 3,” or value chain climate targets.

Selected carriers will gain a new source of revenue to recapture the higher costs of deploying and operating zero-emission trucks compared to traditional internal combustion vehicles. They will also be able to expand zero-emission trucks to regions and routes where uptake is currently slow or nonexistent.

“Book and claim systems drive greater investment into low carbon transport solutions, and its implementation for zero-emission trucks can channel aggregated demand to innovative road freight carriers” said Christoph Wolff, CEO of Smart Freight Centre. “As with book and claim systems for all transport modes, Smart Freight Centre will ensure that emissions attributes can be calculated, accounted for, and reported in the most robust and transparent way.”

Following the proposal review process, GMA Trucking will facilitate multi-year, bi-lateral contracts between participating members and carriers. Based on the robust projected demand and findings from the RFI conducted earlier in 2024, GMA Trucking anticipates awarding contracts to multiple carriers.

Following the pilot procurement, GMA Trucking plans to run recurring RFP processes to help its members purchase zero-emission trucking service attributes on an ongoing basis and accelerate the decarbonization of the heavy-duty trucking sector, which accounts for more than 3% of global carbon emissions. By demonstrating the demand for these services among corporate buyers, the program seeks to jumpstart the adoption of zero-emission trucks in underserved regions, helping reduce costs as additional supply enters the market.

Carriers interested in reviewing and responding to the RFP may access it on GMA’s website at this link. GMA Trucking will host a webinar for potential RFP respondents on January 17, 2025, at 12PM ET. Those interested in participating in the webinar can register here.

About GMA

The Center for Green Market Activation (GMA) is a US-based, globally focused non-profit. Through innovative book and claim systems, new and creative procurement approaches, and demand aggregating buyers’ alliances, GMA catalyzes and scales the uptake of low-carbon goods and services within carbon intensive industries such as aviation, maritime, trucking, cement and concrete, and chemicals. With collective decades of experience in environmental markets and alternative fuels and materials, GMA works to standardize new, green markets and forges mutually beneficial partnerships between climate-focused companies, suppliers, and mission-aligned non-profit organizations to channel funding to critical climate technologies in pursuit of accelerated sectoral decarbonization. For more information, please visit gmacenter.org.

Media inquiries should be directed to pr@gmacenter.org.

About SFC

The Smart Freight Centre (SFC) is an international non-profit organization focused on helping shippers to decarbonize by standardizing methods for emissions accounting and reporting including transportation-focused book-and-claim systems, as well as supporting shippers to select and implement decarbonization strategies. Its work in book-and-claim systems centers on emissions accounting and reporting, providing guidance in its Voluntary Market Based Measures Accounting Framework as well as its assurance program. In road freight, SFC aggregates demand for electric trucking services in specific regions and use cases, bringing together shippers, logistics providers, and fleet owners towards collaborative partnerships and projects.

As seen in:

TheTrucker.com | December 26, 2024

American Journal of Transportation | December 17, 2024

10.01.24

GMA Announces Official Launch of New Chemicals Program

On Tuesday, September 24, the Center for Green Market Activation (GMA) released details related to its work in chemicals, as part of a Climate Week NYC session hosted by the Center for Climate and Energy Solutions and Boston Consulting Group. In what marked the official GMA Chemicals program launch, Kim Carnahan, GMA CEO, described the chemicals decarbonization challenge and the approach GMA and its stakeholders are taking to address a sector that contributes more than 6% of global greenhouse gas emissions.

Products from the chemicals sector are found throughout our daily lives, and chemicals emissions are a sizable and growing issue. Decarbonization efforts are being impeded, at least in part, by structural barriers that will require coordinated efforts to overcome. GMA believes that chain of custody and demand aggregation approaches have an important role to play in this work and is excited to embark on a program to gather critical insights to inform subsequent phases of this endeavor – with the ultimate goal of accelerating decarbonization of the chemicals sector while supporting efforts to address the global plastics waste crisis.

GMA Chemicals has been designed to deliver a range of benefits to its participants drawing from the model GMA has already applied successfully in other hard to abate sectors like aviation, maritime, and heavy-duty trucking. More specifically, GMA aims to do the following, in sequence:

- First, build a chain of custody system that enables the transfer of attributes from high integrity decarbonized chemicals to customers willing to pay a premium for a decarbonized product

- Second, develop a buyers alliance for such customers, aggregating their demand and managing joint procurement on their behalf

GMA will also provide education to buyers alliance members and the broader chemicals stakeholder community on GHG accounting and sustainability certification.

To kick off the system development process, GMA is convening a working group of stakeholders from across the chemicals sector – from producers to buyers, standard setters and NGOs – to ensure that diverse views input into our chemicals system design. Our approach is inclusive, working with both legacy chemicals producers as well as start-ups focused on game-changing decarbonized chemicals technologies.

Program design will continue through the remainder of 2024 and into the first part of 2025, after which GMA will shift our efforts from program design to activating the market through our buyers alliance.

Companies who are interested in getting involved should contact chemicals@gmacenter.org.

09.20.24

Heavy duty transport and the power of buyers alliances to unlock deep decarbonization | Webinar overview and recording

On Thursday, September 12, 2024, decarbonization leaders Kim Carnahan and Andre de Fontaine (Center for Green Market Activation) along with Ingrid Irigoyen (Zero Emission Maritime Buyers Alliance) hosted their first joint public webinar. The session featured insights into how procurement-focused buyers alliances, such as the Sustainable Aviation Buyers Alliance (SABA), ZEMBA, and GMA Trucking are helping companies reduce Scope 3 emissions in hard to abate sectors while catalyzing new markets for low and zero-emission alternatives.

These member-based organizations pool demand to run collective tenders for the green premium associated with low and zero-emission goods and services, co-develop high-integrity book and claim systems and standardized environmental attribute certificate (EAC) registries, create robust sustainability standards to guide procurements, and help ensure companies can accurately claim and report the impact of their investments in climate solutions. Through this work, they help propel impactful action on Scope 3 emission reductions by channeling investment where it is needed most and driving the decarbonization of value chains where the majority of corporate emissions lie. While the three buyers alliances featured are focused on heavy transport, such alliances are powerful decarbonization tools with cross-sectoral applications to other hard-to-abate sectors such as cement & concrete and chemicals.

Over the course of the webinar, the speakers defined the challenges specific to different sectors when tailoring a buyers alliance approach, the importance of tools like book and claim in the early stages of these sectors’ decarbonization journeys, and the significant opportunity to apply common aspects of successful buyers alliance models such as SABA and ZEMBA to drive and scale industrial decarbonization across heavy industry. The panel outlined specific successes where program participants have been able to achieve collective impact, gain early access to high integrity scope 3 reductions, and benefit from economies of scale for green goods and services.

The session concluded with an in-depth Q&A that drew on the expertise of the panel, including questions around the evolution of Scope 3 greenhouse gas accounting, current and emerging registries and guidance, and the potential value of a standardized cross-sector platform for the procurement of environmental attribute certificates.

A recording of the webinar is available by clicking here.

To stay in the know about future opportunities, follow GMA, SABA and ZEMBA on LinkedIn or sign up to receive updates from GMA and ZEMBA using the links at the bottom of the page!

08.29.24

GMA Trucking Buyers Alliance Aggregates Demand for Zero-Emission Trucking, in Partnership with Smart Freight Centre

Innovative buyers’ alliance applies a proven model to drive the decarbonization of heavy-duty trucking, seeks input from carriers in designing first collective procurement

August 29, 2024 (Washington, DC) – Today, the Center for Green Market Activation (GMA), a US-based, globally focused climate non-profit, announced key milestones for its zero-emissions trucking program, GMA Trucking, that aims to scale adoption of zero-emission heavy-duty trucks. Founding members of the GMA Trucking buyers’ alliance, which launched in September 2023, include pioneering companies such as PepsiCo, Meta, eBay, REI Co-op, and Green Worldwide Shipping, who are interested in advancing decarbonization within the heavy-duty road transportation sector. Newly released in conjunction with today’s announcement is a request for information (RFI) intended to inform its upcoming procurement process for zero-emission trucking service attributes utilizing a book and claim model. GMA Trucking has also formalized its strategic partnership with the Smart Freight Centre (SFC), an international non-profit organization focused on reducing greenhouse gas emissions from freight transportation. SFC will bring sector-specific expertise of both road freight decarbonization and book and claim systems to help the buyers’ alliance achieve its objectives.

“Heavy duty trucking accounts for more than 3% of global carbon emissions. Yet, as in other hard-to-abate sectors, deployment of decarbonized solutions has been painfully slow,” said Kim Carnahan, GMA CEO. “With this announcement, GMA member companies have the opportunity to take demand aggregation where it’s needed most, applying the book and claim model to road freight in order to rapidly accelerate the adoption of zero-emission trucks.”

GMA Trucking and its member companies aim to overcome traditional decarbonization hurdles by utilizing a book and claim system for heavy-duty road transportation attributes similar to those already deployed in other markets, such as renewable electricity certificates (RECs), sustainable aviation fuel certificates (SAFc), and, recently, maritime services. Such systems have proven catalytic to market adoption and acceleration of critical technologies and offer a replicable model to drive the decarbonization of other high-emitting industries.

GMA Trucking is preparing for its first pilot procurement of zero-emission trucking service attributes, a process expected to launch in fall 2024. Targeting preliminary volumes from battery electric or hydrogen fuel cell vehicles of up to 110 million ton-miles (or seven million miles with a weighted average payload of 14 tons) per year, the RFP will help GMA Trucking members purchase attributes to make progress towards their greenhouse gas targets and send a strong demand signal to carriers, OEMs, and infrastructure providers to continue investments in zero-emission transportation services. The system will draw from the guidance within SFC’s Market Based Measures (MBM) Framework, a foundational document for logistics book-and-claim that will ensure GMA Trucking aligns with best practices.

“The Smart Freight Centre has been focused on book-and-claim systems for many years because they create the flexibility needed to drive greater investment into low-carbon transportation solutions,” said Christoph Wolff, CEO of Smart Freight Centre. “Our Fleet Electrification Coalition also channels aggregated demand for electric trucking services towards collaborative real-world projects. We look forward to contributing our tools, guidance materials, and expertise to help this program succeed and more rapidly decarbonize the road freight sector.”

To inform the RFP design, GMA Trucking has launched a brief request-for-information (RFI) for carrier responses. The RFI seeks to gather information on existing zero-emission vehicle deployments, interest in expanding ZEV fleets, experience with renewable energy and green fuels, and preferences around multi-year offtake terms. To help those interested in responding to the RFI, GMA has scheduled a webinar for September 17 at 12PM ET to provide further information on the application of book and claim systems for road transportation, how to respond to the RFI, and how to prepare for the RFP.

Through its pilot RFP, GMA expects to select one or more carriers from which to purchase trucking service attributes over a multi-year period. Following the pilot RFP and project contracting, GMA will run recurring RFP processes to help its members purchase zero-emission trucking service attributes on an ongoing basis, growing in scale and scope over time, and helping the road freight sector more rapidly achieve net zero emissions.

Potential respondents who are interested in learning more about the GMA Trucking RFI are encouraged to attend the upcoming webinar. Freight operators are also invited to respond to the RFI by October 11, 2024. More information about GMA and additional cross-sectoral decarbonization opportunities can be found at gmacenter.org or by emailing trucking@gmacenter.org.

About GMA

The Center for Green Market Activation (GMA) is a US-based, globally focused non-profit. Through innovative book and claim systems, new and creative procurement approaches, and demand aggregating buyers’ alliances, GMA catalyzes and scales the uptake of low-carbon goods and services within carbon intensive industries such as aviation, maritime, trucking, cement and concrete, and chemicals. With collective decades of experience in environmental markets and alternative fuels and materials, GMA works to standardize new, green markets and forges mutually beneficial partnerships between climate-focused companies, suppliers, and mission-aligned non-profit organizations to channel funding to critical climate technologies in pursuit of accelerated sectoral decarbonization. For more information, please visit gmacenter.org.

About SFC

The Smart Freight Centre (SFC) is an international non-profit organization focused on helping shippers to decarbonize by standardizing methods for emissions accounting and reporting including transportation-focused book-and-claim systems, as well as supporting shippers to select and implement decarbonization strategies. Its work in book-and-claim systems centers on emissions accounting and reporting, providing guidance in its Voluntary Market Based Measures Accounting Framework as well as its assurance program. In road freight, SFC aggregates demand for electric trucking services in specific regions and use cases, bringing together shippers, logistics providers, and fleet owners towards collaborative partnerships and projects.

As seen in:

The Trucker | September 1, 2024 | GMA seeks industry input on zero-emissions vehicle deployment

DC Velocity | August 30, 2024 | Climate group collects aggregated demand for green trucking

American Journal of Transportation | August 29, 2024 | GMA Trucking Buyers Alliance aggregates demand for zero-emission trucking, in partnership with Smart Freight Centre