01.28.26

Article | Cultivating a lower-carbon food supply chain: Unlocking Scope 3 progress through fertilizer emissions reduction

Authors: Andrew Alcorta and Akhil Mithal (Center for Green Market Activation), Patrick Molloy and Tessa Weiss (RMI)

Agriculture accounts for roughly one-quarter of global greenhouse gas emissions, yet its pathway to achieving net zero defies simple solutions. A wholly climate-friendly food system will require multiple interventions happening in parallel — from regenerative agriculture practices and precision fertilizer techniques to fundamental changes in how we produce the products that help us grow, feed, and support the food we eat. Many of these interventions require behavioral changes across millions of farms that will take time to scale, underscoring the importance of acting decisively where impact can be achieved today. Fertilizer production represents one such opportunity where companies can drive verifiable emissions reductions in the near term.

Nitrogen fertilizers support crops that feed roughly half the world’s population, making them foundational to global food security. The scale of this dependence is stark — without synthetic nitrogen inputs, it is projected that global cereal production would decline by approximately half. While regenerative agriculture practices offer important soil health benefits, relying solely on biological nitrogen fixation would likely require surrendering even more land to crops to maintain current production levels. And the challenge is intensifying: as the global population approaches 10 billion by 2050, fertilizer demand is projected to increase by roughly 35 percent, increasing pressure for continued fossil-linked fertilizer production.

Yet nitrogen fertilizers carry an outsized climate footprint: their production, distribution, and use generate an estimated 1.31 gigatons of CO₂-equivalent emissions annually – the same emissions as consuming 3 billion barrels of oil. Approximately 40 percent of those emissions originate from fertilizer production itself.

Solutions to produce fertilizer with far fewer emissions already exist – renewable-powered electrolysis can eliminate these production emissions entirely – but they cost more than fossil-intensive processes today. Scaling these solutions requires long-term financial commitments that fertilizer producers’ direct customers – input producers and farmers operating on thin margins – are unable to provide. Food and beverage companies face a distinct but related challenge: they need to reduce supply chain emissions, also known as Scope 3 emissions, from the agricultural products they purchase – driven by investor pressure, regulators and sustainability commitments – but lack a mechanism to effectively do so.

The Center for Green Market Activation (GMA) and RMI are launching a pilot book and claim procurement to bridge this gap. In this system, food and beverage companies can financially support low-emission fertilizer projects through the purchase of Environmental Attribute Certificates (EACs) and claim verified emissions reductions toward Scope 3 targets — without requiring physical delivery of low-carbon product through their existing supply chains. Low-carbon fertilizer producers receive revenue certainty to cover green premiums, buyers gain measurable progress on climate commitments, and farmers continue purchasing fertilizer through conventional channels without having to pay more or disrupt their operations.

Scaling technologies to produce low-emission fertilizer

A suite of low-emission fertilizer solutions exists today that can deeply decarbonize production while offering broader benefits like increased supply chain resiliency. Projects like First Ammonia’s in Texas and startups such as NitroVolt, Atlas Agro and TalusAg are pioneering scalable green ammonia production using renewable energy and novel synthesis processes. These technologies can significantly reduce production emissions, increase farmer autonomy over crop nutrition through localized production, and have the potential to reduce input price risk by decoupling fertilizer costs from volatile fossil fuel markets.

However, scaling these solutions faces critical structural barriers. Fertilizer producers need to know they have long-term committed buyers to finance capital-intensive low-emissions projects — but farmers, who typically purchase fertilizer seasonally and operate on thin margins, are unlikely to absorb cost premiums. Further downstream, food and beverage corporations possess both the relative willingness to pay and the creditworthiness needed to support project financing. While low-emission fertilizer currently costs more to produce, the impact on food companies is minimal: premiums would translate to only 1-2% increases in packaged goods prices, far smaller than routine volatility from fuel or commodity markets. Critically, with at-scale deployment, the production cost of green ammonia can decline over time due to learning effects and scale efficiencies.

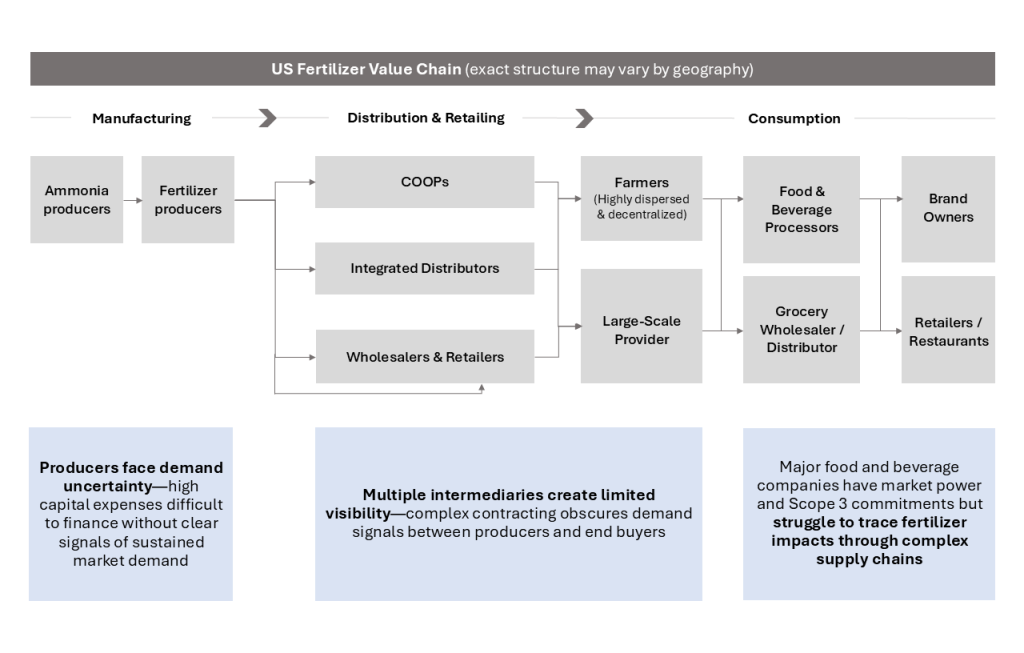

The challenge is that these corporate buyers sit 5-6 steps in the supply chain away from fertilizer manufacturers and have no established mechanism to directly procure or contract for low-emissions fertilizer (Exhibit 1). This long and often fragmented value chain prevents fertilizer producers from monetizing low-emissions production because they lack a relationship with the parties that most value decarbonization.

Exhibit 1: US Fertilizer Value Chain

More than 900 companies across food, beverage, consumer packaged goods (CPG), and agriculture sectors have validated near-term Science-Based Targets under SBTi. Under the GHG Protocol’s Agricultural Guidance, they must account for full value chain fertilizer emissions in their Scope 3 inventories, including fertilizer emissions that can represent a substantial portion of their total GHG footprint. Yet these companies effectively have no way to manage these emissions today: they lack direct relationships with fertilizer producers, creating a gap between sustainability commitments and the operational levers needed to achieve them.

Bridging a Value Chain Gap through Environmental Attribute Certificates (EACs)

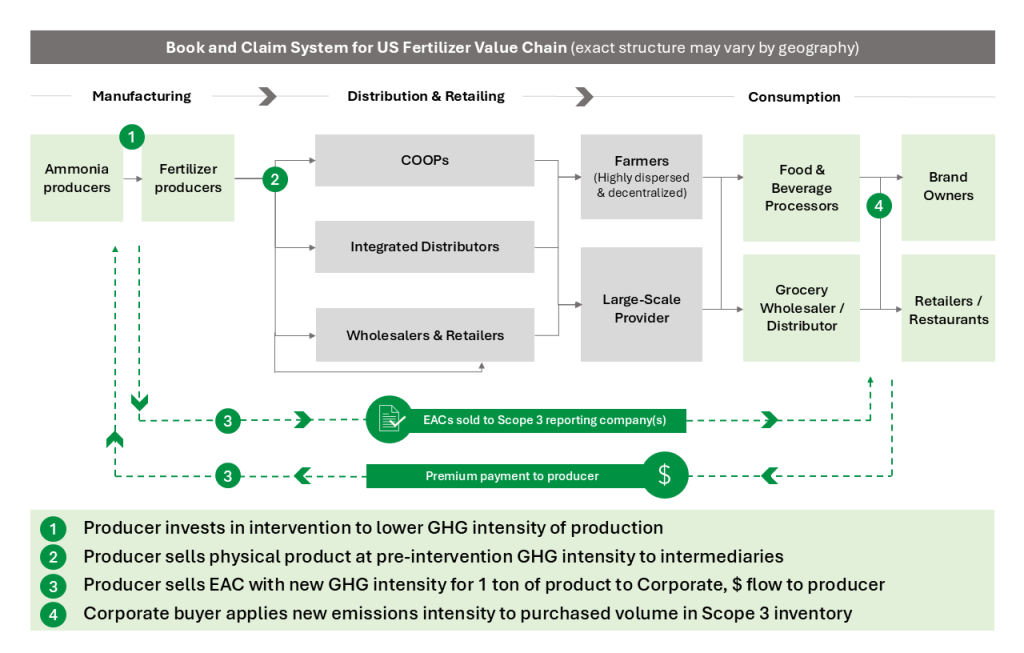

Book and claim systems solve this challenge by decoupling environmental attributes from physical product flow. Under this framework, fertilizer producers generate Environmental Attribute Certificates (EACs) for each unit of low-emission production, which are then sold separately from the physical fertilizer itself (Exhibit 2). Corporate buyers purchase these certificates to demonstrate verified emissions reductions in their Scope 3 inventories, creating a direct financial channel between producers and corporate buyers — regardless of where the physical fertilizer ultimately flows through agricultural supply chains. This structure enables revenue to reach decarbonization projects without requiring companies to engage in complex coordination that alters how farmers source inputs or require that physical molecules are traced all the way through complex value chains.

Exhibit 2: Book and Claim System for US Fertilizer Value Chain

The mechanism aligns incentives across the value chain. Fertilizer producers receive revenue from EAC sales to cover the premium associated with low-emission production, providing the financial certainty needed to finance capital-intensive projects. Buyers gain verifiable, traceable progress on climate commitments through certificates that are independently verified and tracked through registry systems. The physical low-emissions fertilizer enters conventional distribution channels where farmers purchase it at commodity prices, avoiding the need for farmers themselves to spend time sourcing or pay premiums for low-emissions inputs.

GMA and RMI’s Low-Emissions Fertilizer Initiative

GMA and RMI are launching a pilot book and claim procurement to enable fertilizer production decarbonization at scale. By aggregating demand from food and beverage companies with Scope 3 commitments, this initiative will create the collective purchasing power needed to de-risk producer investments and accelerate decarbonization technology deployment. Collaborative buyers alliances can help solve challenges in financing of first-of-a-kind projects by pooling demand across multiple companies, transforming fragmented demand pools into concentrated market signals. This collective approach shares transaction costs, aligns common standards, and delivers the forward contracts that make projects bankable, turning corporate sustainability commitments into impact delivered by real-world investments.

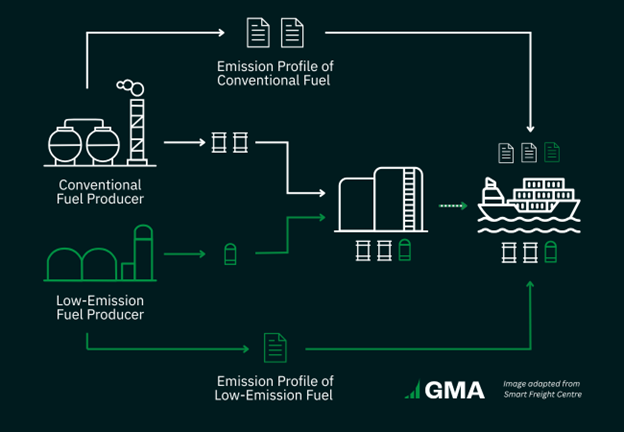

This approach builds on proven models that catalyze investment in new technologies by decoupling emissions attributes from commodity products. Renewable Energy Certificates (RECs) utilized this framework in electricity markets, and similar frameworks are being used for aviation, steel, cement, trucking, maritime fuel, and plastics, accelerating deployment of decarbonization technologies and catalyzing private investment across hard-to-abate sectors.

Across these sectors, success has depended on rigorous market infrastructure. As neutral technical experts, RMI and GMA establish frameworks that balance environmental credibility with commercial practicality — developing clear sustainability criteria for qualifying projects, robust verification protocols, and transparent registry systems that prevent double-counting and ensure corporate investments translate into genuine emissions reductions. By adapting this model to fertilizer, we aim to unlock the financing needed to scale green ammonia and other low-emissions production pathways, addressing one of agriculture’s most entrenched emission sources and giving food and beverage companies a credible path to meet their Scope 3 targets.

Ready to join? If your company has a Scope 3 target that includes fertilizer emissions in your supply chain, this initiative offers an opportunity to achieve your goals and catalyze meaningful agricultural decarbonization. To learn more about participating in the pilot procurement, please contact us at chemicals@gmacenter.org.

12.16.25

GMA Newsletter | A Look Back at 2025

A look back at 2025:

From collective ambition to market transformation

With 2025 soon to be in the rear view, we find ourselves at the midpoint of a pivotal decade for climate action. While the political forecast remains, shall we say, variable, and momentum on climate action has been tested, the organizations we partner with every day continue to champion ambitious voluntary decarbonization commitments.

This year’s progress proves what is possible when motivation is matched with action and grit. (Take a look at our year-end video, above, for some of the high points!) None of it would be possible without the active engagement of hundreds of stakeholders with our programs – thank you for being such a central part of this work.

Before we officially wrap up the year we wanted to highlight milestone developments across two GMA program areas: zero emission trucking and standards and guidance.

A year after launching GMA Trucking’s pilot RFP, we are on the cusp of finalizing contracts for our first procurement for zero emission trucking service attributes. This pilot has shown what’s possible when companies join forces, with demand aggregation and book and claim proving to be powerful levers for getting more zero emission trucks on the road. This effort now sets the stage for even larger procurements starting in 2026.

Among the standout achievements from this first-of-a-kind effort:

- It will result in the largest known deployment of heavy-duty EVs in Texas, and

- It channels catalytic investment to a zero-emissions technology start-up.

(If you missed our announcement of Nevoya as the winning carrier during New York Climate Week, see these video highlights.)

The procurement structure leverages innovative commercial terms, is designed to maximize truck utilization, and helps overcome current barriers to EV trucking. We’ll share more early next year when we announce the full RFP results. In the meantime, mark your calendars for our webinar on January 15 – your backstage pass to lessons learned and what’s coming next.

Companies have been clear – the GHG accounting and target setting standards must evolve to support credible, innovative scope 3 decarbonization. This year, the AIM Platform continued to lead the development of robust methods for companies to take action deep in their value chain and transparently report those efforts.

2025 also saw both the Science Based Targets Initiative (SBTi) and GHG Protocol (GHGP) recognize the importance of value chain mitigation. We applaud their commitment and continue working closely with both to ensure alignment and interoperability across frameworks.

Over 2025, the AIM Platform:

- Conducted pilot tests and public consultation on the AIM Platform Association Test and the Intervention Quality, Accounting and Reporting (QAR) Standard and Guidance,

- Released a draft Electricity Annex for stakeholder consultation, and

- Engaged over 40 leading organizations whose real-world testing is directly informing the tools to come.

This collective input will shape the complete AIM Platform Standard and Guidance we expect to publish in Q1 2026. Stay tuned – 2026 is going to be another big year for game-changing developments in the standards space.

In brief:

- Jim Giles featured multiple GMA programs in a recent Trellis article on the growing use of environmental attribute certificates.

- If you attended COP30, the SABA COP30 SAF platform remains open for purchases through the end of this year. The first several hundred purchases will have double the impact through a matching sponsorship courtesy of Airbus.

- Trellis highlighted the AIM Platform QAR pilot, which was also the subject of a webinar held earlier this fall. You can access a recording here.

- #ICYMI, a session-by-session video library from Green Markets Day 2025 can be accessed from our website.

With gratitude:

To our partners at Aspen Institute, C2ES, EDF, Gold Standard, RMI, and Smart Freight Centre – we deeply value the opportunity to work alongside you. We are in this together for as long as the need exists, and look to the new year with optimism, excitement, and resolve. And to everyone at GMA – thank you for the irreplaceable skill, commitment, and spirit of collaboration you bring to our work together. We are so fortunate to have each of you as part of this dream team.

Best wishes for a safe, healthy, and happy holiday season!

See you in 2026!

12.08.25

As Seen in Trellis: A wonky accounting device is becoming an essential part of climate strategies

In a Trellis article published December 4, 2025, Editor-at-Large Jim Giles takes a closer look at environmental attribute certificates and how they are helping drive new and catalytic investment to decarbonized fuels, technologies and services. The article kicks off with a nod to the growing awareness of and implementation of programs using EACs, followed by a quote from GMA CEO Kim Carnahan:

– – – – – – – – – – – – – –

“This may have been the year when a somewhat wonky component of sustainability strategy — the environmental attribute certificate (EAC) — went mainstream. The past 12 months have seen certificates for low-emission products minted in multiple sectors, including cement, iron and carbon capture. In parallel, standard setters are close to giving companies greater leeway to use certificates in carbon accounting and target setting.

‘It definitely feels like this year something really clicked across the board — with buyers and suppliers, but also the standard setters seem to be getting it, the environmental NGOs, even governments,’ said Kim Carnahan, CEO of the nonprofit Center for Green Market Activation (GMA).'”

– – – – – – – – – – – – – –

The article continues with an exploration of various sectors where EACs are working to overcome market barriers, highlighting individual projects helping decarbonize data centers as well as buyers alliances that aggregate demand for low and zero emission solutions from groups of climate-leading companies, allowing them to send a stronger signal to the market and support growth in supply. These include programs that GMA co-manages alongside our NGO partners, including the Sustainable Aviation Buyers Alliance (SABA), Sustainable Concrete Buyers Alliance (SCoBA), zero-emission trucking and low-carbon chemicals.

Click here for the complete article.

11.13.25

Perspectives on SBTi’s Second Draft Corporate Net Zero Standard V2 from GMA CEO Kim Carnahan

Following the release of the second draft of the corporate net-zero standard V2 from SBTi on November 6th, 2025, GMA CEO Kim Carnahan shared her insights on what this update means for sector-level decarbonization efforts and programs that utilize book and claim, and where opportunities remain to refine the final draft to make it most useful and effective. GMA encourages stakeholders to engage with the public consultation period that ends December 8, 2025.

Kim’s original LinkedIn post is copied here, below.

“ICYMI: the next version of the DRAFT V2 Science Based Targets initiative Corporate Net Zero Standard is out.

It’s clearer, (somewhat) simpler, and takes many steps in the right direction.

It includes even more clarity (compared to the last draft) that indirect mitigation will count towards climate targets.

The First Public Consultation Feedback Report, also released today, shows why: ~80% of respondents supported counting indirect mitigation toward target achievement. Mandate sent.

I specifically like several adjustments they made to the indirect mitigation concept – now called “sector level actions.” The Advanced and Indirect Mitigation (AIM) Platform (www.aimplatform.org) supports this theory of change: even if a company lacks traceability or direct access to solutions, they still need to work to decarbonize the sectors that form the building blocks of their business.

Unfortunately, a few BIG holes remain in this otherwise gold star product.

Hole #1

– The draft appears to say that indirect mitigation can count towards some but not all scope 3 target types. I am perplexed as to why the clear mandate received would apply to some but not all target types.

– I get the current situation is complex with the overlapping GHG Protocol revision process. But one thing is not complex: Companies need the strongest and loudest signal possible to invest in critical decarb technologies now – and it is SBTi’s job to give that signal.

– GHG Protocol is policy agnostic and can provide the tools to meet any target. In fact, it has already convened a technical working group (I’m a proud member) to develop them.

Hole #2

Where is project-based accounting for indirect mitigation? I’m a huge proponent of product based, attributionally accounted EACs but some (very important) work requires project-based accounting. There needs to be a clear place for it in target achievement, or it simply won’t get done.

Hole #3

What about companies who already have V1 targets? I realize this standard will apply to future targets but we need a cover page (or similar) that clearly states that indirect mitigation will count, in all the same ways, to V1 targets.

And finally, with the overall complexity of the target setting approach outlined in this draft: I understand what SBTi is trying to engineer with this approach. I’m worried that logic will not equal effectiveness in this case, however. Companies need to be able to communicate these targets, clearly and succinctly – internally and externally. SBTi and all of us who support them will be more successful if companies can distill all the targets and sub-targets into the language we speak now – emission reductions.

All in all, huge progress. I very much believe we will get there in the final draft.”

10.29.25

Green Markets Day 2025 – Session Recordings Now Available

Green Markets Day 2025, held on September 23 during New York Climate Week, highlighted groundbreaking efforts and innovative approaches turning climate ambition into real-world action.

The Center for Green Market Activation, in partnership with Lowercarbon Capital and in collaboration with RMI and Smart Freight Centre, brought together suppliers, investors, standard-setters, and policy leaders for an unforgettable afternoon of candid debate, bold advances, and practical insights on scaling solutions in the toughest sectors to decarbonize – no matter which way the political winds blow.

Video recordings and transcripts are available at the links below by clicking on each session title.

Session Recordings

Welcome and State of the Market

Kim Carnahan, CEO, Center for Green Market Activation (GMA)

Trucking RFP Winners Announcement followed by Panel – Big Bet: Unlocking the Future of Trucking

Andre de Fontaine, Managing Director, GMA (moderator)

Christoph Wolff, CEO, Smart Freight Centre

Melissa Bauer, ESG and Sustainability Strategy Lead, eBay

Sami Khan, Co-Founder and CEO, Nevoya

SABA Spotlight: COP30 Campaign Announcement

Andrew Chen, Principal, RMI

Climate Intelligence Spotlight: RMI’s Climate Intelligence ‘Catalytic Procurement’ Report

Josh Henretig, Managing Director, RMI

Fireside Chat: Can Advance Market Commitments Jumpstart Climate’s Hardest Sectors?

David Roberts, Writer and Owner, Volts Podcast

Clay Dumas, General Partner, Lowercarbon Capital

Panel – Reaching Scale, Attracting Capital

Paul Bodnar, Director of Sustainable Finance, Industry, and Diplomacy, Bezos Earth Fund (moderator)

Brandon Middaugh, GM/Partner, Sustainability Markets and Climate Innovation Fund, Microsoft

Laura Helman, Senior Vice President, Brookfield

Rama Variankaval, Global Head of Corporate Advisory and Sustainable Solutions, JPMC

Jigar Shah, Co-Managing Partner, Multiplier

Campaign Spotlight: Mission Possible Partnership’s Build Clean Now Campaign

Michel Frédeau, Senior Fellow, Mission Possible Partnership

Panel – Concrete Steps, Steel Resolve, and Clean Chemistry: Heavy Industry’s Next Moves

Bryan Fisher, Managing Director, RMI (moderator)

Chris Atkins, Director, Worldwide Operations Sustainability, Amazon

Leah Ellis, CEO and Co-Founder, Sublime

Johan Mandaric Reunanen, Climate Impact Lead, Stegra

Hans Olav Raen, CEO, Yara Clean Ammonia

Panel – Founders at the Frontier: Startup CEOs Talk Scaling Climate Tech

Lauren Faber O’Connor, Partner, Lowercarbon Capital (moderator)

Gregory Constantine, CEO and Founder, AirCo

Sarah Lamaison, Co-Founder and CEO, Dioxycle

Sandeep Nijhawan, CEO, Electra

Hiro Iwanaga, CEO, TalusAg

10.16.25

GMA Newsletter – Fall 2025 | Post New York Climate Week

See below for the online version of GMA’s Fall 2025 newsletter, distributed shortly after New York Climate Week. To receive future editions directly to your inbox, sign up through the form at the bottom of our homepage or email pr@gmacenter.org to be added to our mailing list.

Above: a one-minute video recap of the 2nd Annual Green Markets Day at New York Climate Week 2025.

Thinking about the state of voluntary climate action in the wake of this year’s New York Climate Week, we are reminded of Mark Twain’s famous quote: “Reports of my death are greatly exaggerated.” We at GMA were thrilled by the response to our second annual Green Markets Day – an exceptional afternoon of programming that welcomed more than 450 attendees and launched several new initiatives centered around this year’s theme, Signals That Move Markets (detailed below). The energy and excitement in the room was palpable – much appreciation to Lowercarbon Capital, RMI, and Smart Freight Centre for all of the valuable support and collaboration on this event.

With our team spread out across nearly four dozen events throughout the week, we were proud to add our voices and perspectives to accelerating efforts that activate demand, mobilize investment, and scale green fuels, technologies, and services. Looking out to the end of the year and into 2026, we carry that same determination and energy into tackling the toughest and highest impact decarbonization challenges. Thank you for being with us on this journey.

The GMA Team

Program Updates

Trucking

Nevoya Wins Pilot RFP: GMA Trucking, in strategic partnership with Smart Freight Centre, announced Nevoya as the winner of its pilot RFP live on stage at Green Markets Day 2025. This first-of-its-kind procurement will lead to the largest known single deployment of class 8 battery electric vehicles in the State of Texas and create a dedicated, all-electric shipping route between Dallas and Houston. Read more about it here and watch our latest video highlighting GMA Trucking’s pilot procurement. To learn more and get involved, email trucking@gmacenter.org.

Aviation

SABA COP30 SAFc Campaign Takes Flight: SABA introduced an innovative platform to help COP30 attendees cut flight emissions. With the SABA COP30 SAF platform, travelers to Belém can calculate and address their aviation-related emissions by purchasing high integrity SAF sourced from SkyNRG. You can purchase SAFc through the program here or join us for a webinar on October 22 to learn more. Register here.

SAFc Connect Ready for 2026 Volume Offtake: Introduced in May 2025, SAFc Connect is a market accelerating tool for SABA members to easily find and purchase SAF certificates. With 10 SAFc providers already on the platform, many with multiple different offers, SABA customers have streamlined access to a range of competitively priced SAFc options to choose from. If you are not yet on the platform, please email SAFcConnect@gmacenter.org to get started!

Cement & Concrete

Official Launch of SCoBA: GMA, along with our partners at RMI, announced the launch of the Sustainable Concrete Buyers Alliance (SCoBA), a first-of-its-kind group of leading organizations collaborating to speed the adoption of low-carbon cement and concrete. Coinciding with the launch was the release of an RFI for lower-carbon cement and concrete, a key milestone on the path to SCoBA’s pilot procurement planned for late 2025. To learn more, email info@buildscoba.org.

Chemicals

RFI for Low-Emission Ethylene: GMA and RMI announced an RFI for low-emission ethylene as part of our joint Low-Emission Chemicals program. We invite innovative producers to respond by Friday, November 7, 2025. For more information, click here.

AIM Platform

The AIM Platform is following an ambitious timeline to publish Version 1 of its Standard and Guidance in early 2026, including two recent milestones:

QAR Standard and Guidance: Designed to provide companies with reliable requirements and guidance on how to account for and report on qualified value chain interventions, the Intervention Quality, Accounting, and Reporting (QAR) Standard and Guidance is open for stakeholder feedback through November 21. If you’re interested in being a part of the public consultation or are otherwise curious to learn more, register for our upcoming webinar on Thursday, October 16.

Electricity Annex: Developed as a supplement to the Association Test and QAR Standard and Guidance, the AIM Platform just released a draft of the Electricity Annex for stakeholder comment. Companies with Scope 3 electricity emissions are encouraged to review and share feedback by December 5.

Maritime

Second Tender Approaching the Finish: The Zero Emission Maritime Buyers Alliance (ZEMBA) has been focused on its second tender process. Launched earlier this year, this tender is exclusively focused on e-fuels achieving greater than 90% reduction in emissions compared to fossil fuels. ZEMBA is now nearing the finish line, and the winner will be announced around the end of the year.

New Publications from Our Partners

- Corporates can play a catalytic role in driving systemic change through their procurement actions. RMI’s Catalytic Procurement report shows how purchasing power can unlock low-emission markets, scale breakthrough technologies, and leverage innovative market mechanisms across different sectors. Explore RMI’s resources here.

- Climate Week NYC saw the launch of Build Clean Now, a global campaign from the Industrial Transition Accelerator and Mission Possible Partnership, with a clear ambition: to accelerate, year-on-year, the financing and construction of clean industrial plants, building unstoppable momentum toward 800+ projects by 2030. Learn more here.

In the News / #ICYMI

-

The launch of the Sustainable Concrete Buyer’s Alliance (SCoBA) was featured in CNBC’s Property Play, edie, BusinessGreen News, and others.

-

SABA’s COP30 SAFc campaign was covered by SAF Magazine, BusinessGreen News, Quantum Commodity Intelligence, and more.

-

The work of GMA Trucking was highlighted on the Volts podcast in a conversation recorded live at Green Markets Day.

-

Quantum Commodity Intelligence reported on a webinar hosted by RMI and featuring GMA’s Andrew Alcorta discussing our work decarbonizing fertilizer.

The GMA team was out in force for Green Markets Day 25 at New York Climate Week.

Upcoming Events

Sustainable Aviation Futures North America 2025 | October 14-16, 2025 | Houston

Andre de Fontaine will moderate a panel of high-level SAF stakeholders as part of the plenary session, “Is There an Acceptable Price for SAF? Price Discovery and Demand Signals.” Click here for more information.

Ammonia Energy Association Annual Conference | October 20-22, 2025 | Houston

Ash Khetpal will speak on the panel “Accelerating Adoption through Demand Aggregation and Financing Mechanisms.” Click here for more information.

VERGE hosted at Trellis Impact 2025 | October 28-30, 2025 | San Jose

GMA representatives will take part in multiple panels throughout the conference. Click here for more information.

AFCC Global Biobased Economy Conference & Exhibit | November 16-18, 2025 | Washington, DC

Andre de Fontaine will speak on the panel “Demystifying the Biggest Black Box in SAF: Monetizing Scope 3 Emissions.” Click here for more information.

09.19.25

Sustainable Concrete Buyers Alliance Launches to Accelerate Adoption of Low-Carbon Building and Infrastructure Materials

New RMI and Center for Green Market Activation initiative will enable Amazon, Prologis, Meta, and other leading organizations to participate in a first-of-its-kind joint purchase of sustainable concrete attribute certificates, driving investment into cutting-edge production facilities, low-carbon cement blends, and emerging technologies.

Washington, D.C. – September 19, 2025

In a landmark step for the cement and concrete sector, RMI (founded as Rocky Mountain Institute) and the Center for Green Market Activation (GMA) today launched the Sustainable Concrete Buyers Alliance (SCoBA), bringing together founding members, including Amazon, Prologis, and Meta, alongside other leading organizations to accelerate adoption of low-carbon cement and concrete for 21st century buildings and infrastructure. SCoBA is the first buyers group formed to collectively procure environmental attribute certificates for low-carbon concrete, aiming to turn demand into real-world offtake agreements that enable producers to invest at scale in new infrastructure and pioneering technologies.

The cement and concrete sector accounts for around 8 percent of global carbon emissions and is predicted to grow significantly by 2050, but low-carbon options are currently not available at scale. The emissions from construction of factories, warehouses, data centers, and offices are difficult to address due to the embodied carbon from construction materials. SCoBA will leverage an innovative book and claim system to enable companies to purchase the environmental attributes from sustainable concrete and upstream products such as cement and clinker, reducing their associated supply chain emissions, and generating additional revenue to help finance capital-intensive decarbonization projects.

“The cement and concrete sector’s decarbonization challenge is also one of its greatest economic opportunities,” said Jon Creyts, CEO at RMI. “By aggregating demand from major buyers and establishing rigorous standards, we’re creating the market conditions for breakthrough low-carbon cement innovations to scale. RMI is proud to work with GMA and leading organizations to launch SCoBA and enable concrete producers to invest confidently in clean and resilient materials that lead to economic benefits.”

Later this year, SCoBA will begin to connect members with leading producers through a first-of-its-kind competitive procurement process for low-carbon cement and concrete certificates to meet the collective demand of its founding members and spur clean tech innovation. The first request for information (RFI) is open now, seeking information from suppliers about the current availability of low-carbon cement and concrete and its performance characteristics, prospective use cases, and operational approaches for environmental attribute certificates, as well as any opportunities or challenges related to participating in a book and claim system.

“SCoBA builds on proven approaches from other hard-to-abate sectors, bringing aggregated buyer demand to the concrete industry,” said Kim Carnahan, President and CEO at GMA. “By connecting buyers and suppliers through a credible book and claim framework, we can unlock the investments needed to scale next-generation cement and concrete solutions in one of the world’s most emissions-intensive industries.”

Book and claim is a market-based system that allows the environmental benefits of a product, like low-carbon cement and concrete, to be decoupled from its physical delivery. This system enables buyers to financially support sustainable production, regardless of where the materials are used, offering flexibility and scalability in decarbonization strategies. Book and claim is particularly effective in industries with complex supply chains in the beginning phases of technological transformation, allowing companies to make credible emissions reduction claims while accelerating market transformation.

SCoBA is leveraging a draft book and claim framework developed over a year-long stakeholder consultation process facilitated by GMA and RMI. This process featured a 30-member Working Group composed of experts across the cement and concrete value chain that met monthly to align on key design criteria to ensure the book and claim system promotes only high-integrity environmental outcomes. The draft framework is undergoing a comment and revision period and will continue to be refined over time with learnings from early attribute transactions.

“SCoBA represents a significant advancement in how we approach sustainable construction materials,” said Chris Atkins, Director, Worldwide Operations Sustainability at Amazon. “Its innovative procurement process and book and claim framework provide the tools needed to support lower-carbon concrete production at scale. Such efforts are critical in driving the broader market toward the materials needed for a net-zero future.”

RMI and GMA are leveraging their expertise from successful initiatives in other sectors, including the Sustainable Aviation Buyers Alliance (SABA), Sustainable Steel Buyers Platform, and GMA Trucking. Through these initiatives, RMI and GMA are encouraging the adoption of sustainable fuels and materials to lower the climate impact of some of the most emissions-intensive industry and transport sectors.

By aggregating and activating demand from major buyers, SCoBA aims to catalyze a transformation in the concrete industry—incentivizing development, deployment, and uptake of low-carbon materials, driving down emissions from the built environment, improving public health, and building a cleaner future from the ground up.

“Low-carbon cement and concrete are essential to decarbonizing the built environment and this alliance will help bring next-generation solutions to scale for the benefit of our customers,” said Keara Fanning, Director of Net Zero and Sustainability at Prologis.

To join SCoBA, please reach out to info@buildscoba.org.

To respond to the RFI, please visit: https://gmacenter.org/program/cement-concrete/. Submissions are due by October 17th, 2025.

Media Inquiries, please contact:

- Alison Greene, Communications Manager, GMA E: alison.greene@gmacenter.org

- Chris Potter, Media Relations Manager, RMI T: 603-831-4189, E: cpotter@rmi.org

About the Center for Green Market Activation

The Center for Green Market Activation (GMA) is a US-based, globally focused non-profit. Through innovative book-and-claim systems, new and creative procurement approaches, and demand aggregating buyers’ alliances, GMA catalyzes and scales the uptake of low-carbon goods and services within carbon-intensive industries such as aviation, maritime, trucking, cement and concrete, and chemicals. With collective decades of experience in environmental markets and alternative fuels and materials, GMA works to standardize new, green markets and forges mutually beneficial partnerships between climate-focused companies, suppliers, and mission-aligned non-profit organizations to channel funding to critical climate technologies in pursuit of accelerated sectoral decarbonization. For more information, please visit gmacenter.org.

About RMI

Rocky Mountain Institute (RMI) is an independent, nonpartisan nonprofit founded in 1982 that transforms global energy systems through market-driven solutions to secure a prosperous, resilient, clean energy future for all. In collaboration with businesses, policymakers, funders, communities, and other partners, RMI drives investment to scale clean energy solutions, reduce energy waste, and boost access to affordable clean energy in ways that enhance security, strengthen the economy, and improve people’s livelihoods. RMI is active in over 60 countries. For more information, please visit rmi.org.

06.17.25

GMA Newsletter – Summer 2025

See below for the online version of GMA’s Summer 2025 newsletter. To receive future editions directly to your inbox, sign up through the form at the bottom of our homepage or email pr@gmacenter.org to be added to our mailing list.

A message from Kim

Kim Carnahan, GMA CEO

As summer begins, I’m reflecting on GMA’s first full year. It’s safe to say we came out swinging – we’ve launched new programs, grown existing initiatives, set and met ambitious milestones, and expanded our staff from 4 to 24 (!!!) to support this important work. The slideshow video linked above summarizes the highlights – please check it out!

As we look ahead to year two, our momentum continues to accelerate. I’m relieved (seriously) to share that GMA has officially been granted 501(c)3 status, bolstering our ability to fulfill our mission effectively. At the midway point of a tumultuous 2025, we’re also encouraged by strong signals from SBTi that it sees the crucial role indirect mitigation plays in overcoming barriers to addressing value chain emissions.

We’re excited to engage in the expert working group they set up to support their Corporate Net-Zero Standard revision process, as well as similar expert groups under the GHG Protocol revision process. Standard setting can be grueling work but it’s critical to create the right incentives and guardrails for climate action.

To support these efforts, we’re also digging in and sharing our deep technical expertise on the complex mechanics of market-based value chain decarbonization through our GMA Insights series (keep scrolling to find links to our latest publications below and really nerd out).

We are confident that the book and claim systems we design with our partners will meet any guardrails SBTi may put in place, and we are doubling down on our joint procurement efforts to ensure companies have avenues to meet their ambitious SBTs. We are currently reviewing bids from our first GMA Trucking pilot procurement and have been blown away by the number and quality of the bids, as well as the enthusiasm and commitment of the carriers. There are some truly game-changing companies in the mix. If you’re not a member of GMA Trucking yet and are interested in decarbonizing your on-road freight, please get in touch! There is still time to join this first-of-kind procurement.

While I couldn’t be prouder of our accomplishments in year one, we recognize it’s still an uphill battle. Luckily, I love running hills! See you all soon, hopefully in real life. Until then, keep up the good fight.

Program Updates

Aviation

Our work with the Sustainable Aviation Buyers Alliance (SABA) reached important milestones, including the launch of two procurement tracks designed to encourage near and long-term investment into sustainable aviation fuel (SAF). SABA’s next-generation SAF procurement is aimed at helping move a next-generation SAF plant to final investment decision, while SAFc Connect is a first-of-its-kind platform to connect buyers with high integrity SAFc volumes that are available now. Notable updates within the recently published revision of SABA’s Sustainability Framework for SAF include the addition of SABA-eligible SAF registries and how fuels can meet the “SABA Advanced” criteria.

Trucking

The GMA Trucking pilot RFP response period closed at the end of April and the evaluation and shortlisting process will culminate with winner selection later this summer. Due to larger than anticipated bid volumes, GMA Trucking is opening up additional purchase opportunities for zero emission trucking service attributes. Email trucking@gmacenter.org to learn more.

Cement & Concrete

Alongside program partner RMI, we continue our work on book and claim system design, with subgroups of the Working Group exploring key design elements such as accounting and baselining in greater depth. Most recently, the Working Group aligned on a multi-functional unit system that would allow for investment in low-carbon clinker, cement or concrete solutions within a common framework and registry. The demand aggregation phase of our work is planned for launch in early fall with the formation of a buyers alliance focused on low-carbon cement and concrete. Email concrete@gmacenter.org to learn more.

Chemicals

Chemicals program design continues under the new leadership of Andrew Alcorta, who joined the GMA team in May. Watch this video narrated by team member Ash Khetpal to learn more about the program’s focus and intent, which in the near term will support the launch of an early stage pilot procurement for low emission plastics and fertilizers.

Sound interesting? Reach out to chemicals@gmacenter.org to explore participation in our soon to launch, early stage pilot!

AIM Platform

The AIM Platform Association Test pilot came to a successful conclusion, and feedback from diverse stakeholders will inform updates currently underway. The Association Test is intended to aid corporates in identifying which decarbonization investments can be credibly associated with their value chains. Next in the AIM Standard and Guidance development process is the release of the draft Quality, Reporting, and Accounting (QAR) Requirements. A pilot and stakeholder comment period for the QAR will launch later this summer and will be followed by a revision process. Together, the Association Test and QAR Requirements will make up the full Standard and Guidance, which will be considered by the AIM Standard Governing Committee for approval and publication in Q4 2025.

Maritime

The Zero Emission Maritime Buyers Alliance (ZEMBA) and Katalist recently published an open letter with 13 signatories in reaction to SBTi’s recent revision of the Corporate Net-Zero Standard and Guidance. The letter focuses on the importance of indirect mitigation efforts in facilitating the clean energy transition for maritime, following the themes established in the group’s engagement with SBTi’s public consultation period. The RFP response period for ZEMBA’s e-fuel-focused second tender closed in April with results expected to be announced by end of 2025.

In the News

- SABA’s SAFc Connect was featured in Trellis: $30 million spend expected at new sustainable aviation platform

- Energy Institute | New Energy World covered the release of SABA’s next-gen RFP: US scales up SAF with major developments

- Our cement & concrete work in partnership with RMI was highlighted in recent announcements about Microsoft’s collaboration with Sublime to decarbonize its construction operations.

#ICYMI

- Don’t miss our latest GMA Insights:

- Watch our newest explainer video focused on book and claim for zero emission trucking and our work in strategic partnership with Smart Freight Centre.

- Listen to the SAF Investor podcast for a conversation with Andre de Fontaine discussing SABA and SABA’s 2025 procurements.

- Learn more about pathways to sustainable flight – SABA’s May webinar is viewable on demand.

Upcoming Events

California Global Hydrogen Energy Transition Summit

June 30-July 1 | Sacramento, CA

Edmond Yi is participating in the session, “H2 Certification – Standardizing Green-e and International Certification of Clean/Renewable H2”

GMA is a Supporting Sponsor of this event.

Argus North Americas Biofuels, LCFS & Carbon Markets Summit

September 15-17 | Monterey, CA

Edmond Yi is an invited speaker for this event.

Climate Week NYC 2025

September 21-28, 2025 | NYC

GMA representatives will be participating in a diverse agenda of convenings and discussions. Stay tuned for details on the week’s events, including the second annual Green Markets Day.

SAF North America Congress 2025

October 14-16, 2025 | Houston

GMA will be joined by SABA stakeholders for sessions focused on corporate action in the SAF market.

VERGE hosted at Trellis Impact 2025

October 28-30, 2025 | San Jose

GMA representatives will participate in multiple panels throughout the conference. Stay tuned for more!

06.03.25

GMA Insights | Why System Boundaries Matter: Exploring Various Market-based Approaches to Deep Value Chain Decarbonization

INTRODUCTION

Welcome back to GMA Insights, a series where we explore concepts related to high-integrity market-based value chain decarbonization. In the first installment of the series, we introduced the concept of chain of custody models and explained “book and claim” – the model used most often by GMA – in greater detail.

But why do different chain of custody models exist? Is one “better” than another? In short, which model is “best” will depend on the situation, and on the goals of the company applying the model. Each model follows a unique methodology and has its own set of rules. Some are focused on detailed tracking of physical products within a system. Others focus more on tracking the characteristics inherent in a set of products or materials, whether or not these characteristics keep their 1:1 attachment to physical products within that system.

Today, we’ll do a deeper dive into two different chain of custody models: book and claim and mass balance. We’ll explain how each of them works and the rules that must be followed within each model. Given that companies can – and do – use both of these models to track the impact of their decarbonization efforts, we’ll explore why one might be preferable to another, depending on which goals an organization is trying to achieve.

So let’s get to it, starting with some fundamentals about both the book and claim and mass balance models.

MASS BALANCE CHAIN OF CUSTODY MODEL

A mass balance chain of custody model allows for physical mixing of materials with specified characteristics with other materials that do not have those characteristics. Despite this physical mixing, in a mass balance model the materials with specified characteristics are tracked as they move through a process or distribution system. The total amount of materials that are documented entering the process or system must match (taking into account process or system losses) the amount of materials that are documented coming out of the process or system.

For example, in a fuel distribution network a low emission fuel may be mixed with a fossil fuel that does not have a low emission profile. If a mass balance model is employed, at each phase in the fuel distribution network, the amount of low emission fuel and the amount of fossil fuel is tracked and documented. That is, the distribution network managers would know that, of X gallons of fuel in a storage facility in the network, Y gallons are theoretically low emission fuel and Z gallons are theoretically fossil fuel. The number of low emission fuel attributes assigned to fuel withdrawn from the fuel distribution network must match the number of gallons of low emission fuel that was added to the network. See Figure 1.

Figure 1: A mass balance chain of custody model.

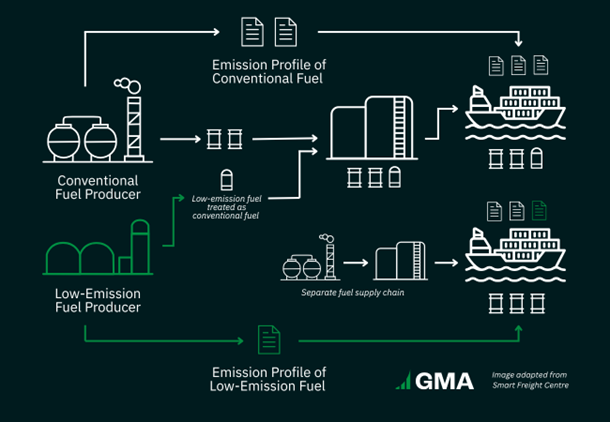

BOOK AND CLAIM CHAIN OF CUSTODY MODEL

A book and claim chain of custody model also allows for physical mixing of materials with specified characteristics with other materials that do not contain those characteristics. In a book and claim model, though, the amount of materials with specified characteristics does not need to be tracked and documented at each step of the process or distribution system. Instead, the characteristics of the inputs are completely decoupled from the physical materials at or before the point of mixing. These characteristics are then tracked separately from the flow of the physical material. The materials’ characteristics are recorded and transferred in a documentation system (e.g., a registry) to ensure the integrity of accounting for these characteristics.

Applying these ideas to our example from above, a low emission fuel may still be mixed with a fossil fuel that does not have a low emission profile. But under the book and claim model, the low emission fuel’s emission attributes are completely separated from the fuel before or at the point of mixing. Once the low emission fuel and fossil fuels are mixed, the combined physical fuel is treated as if it had no low emission characteristics. The attributes of the low emission fuel are tracked and transacted independent of the physical fuel product. See Figure 2.

Figure 2: A book and claim chain of custody model.

Program spotlight: The Sustainable Aviation Buyers’ Alliance (SABA), a program that GMA runs in partnership with Environmental Defense Fund and RMI, relies on the book and claim model. Sustainable aviation fuel (SAF) is mixed with conventional jet fuel, with the physical mix of SAF and conventional jet fuel distributed and sold as though it were all conventional jet fuel. The low emission attributes of the SAF are completely separated from the physical SAF and transacted by means of SAF certificates in the SAFc registry.

THE IMPORTANCE OF SYSTEM BOUNDARIES

A chain of custody model’s boundary, in general terms, establishes where a company draws the line to ensure that products and characteristics going into a system (e.g. a manufacturing or refining process) match those emerging at the end. It may be surprising to see how much this decision can impact how companies can assign characteristics to their products.

Let’s explore this idea by imagining a bustling metropolis that’s home to many companies that specialize in baking wheat into delicious loaves of bread.

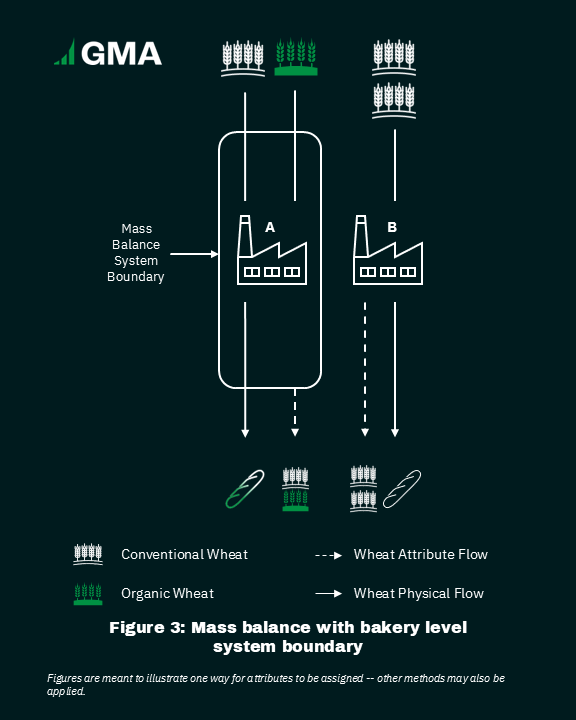

Company 1: Mass Balance with a Bakery Level System Boundary

Company 1 operates two bakeries: Bakery A and Bakery B.

Bakery A receives both conventional wheat and organic wheat from its wheat suppliers. The conventional wheat and organic wheat are mixed together at the bakery and made into bread.

Bakery B does not use any organic wheat to make bread.

The company applies a mass balance chain of custody model to attribute wheat characteristics to loaves of bread, and sets the model boundary at the bakery level. See Figure 3 below.

While Company 1 cannot be sure that every single loaf of bread baked at Bakery A contains organic wheat, the company does know that over a certain period of time, the wheat in the loaves of bread (in totality) baked at Bakery A was 50% organic wheat.

In this example, the system boundary (i.e., Bakery A) matches the boundary for material (i.e., wheat) flows. A buyer sourcing all of the bread from Bakery A would receive, over the period of time during which Bakery A conducted its mass balance[1], bread that physically contained 50% organic wheat.

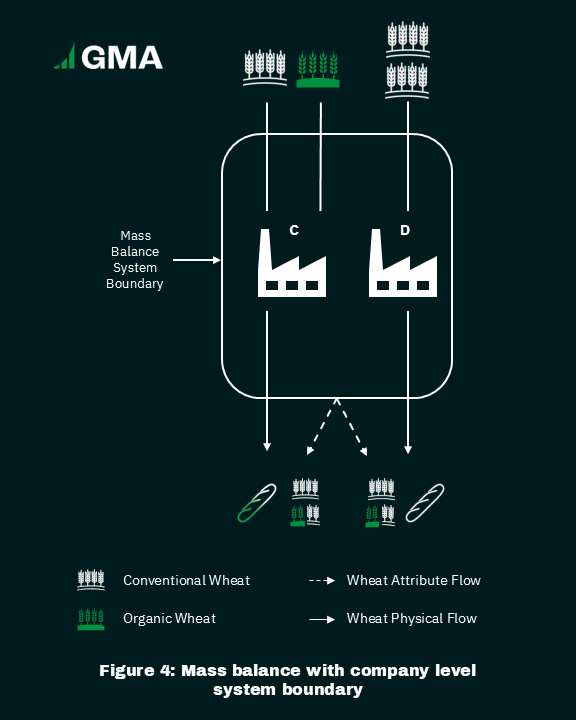

Company 2: Mass Balance with a Company Level System Boundary

Company 2 also operates two bakeries: Bakery C and Bakery D. The inputs for the two bakeries are the same as they were in the previous example, but the system boundary is drawn in a different place.

Bakery C receives 50% conventional wheat and 50% organic wheat from its wheat suppliers. The conventional wheat and organic wheat are mixed together at the bakery and made into bread.

Bakery D does not use any organic wheat to make bread.

The company applies a mass balance chain of custody model to attributing wheat characteristics to loaves of bread, and sets the model boundary at the company level. See Figure 4 as follows.

Unlike Company 1, Company 2 has set its mass balance system boundary at the company level. As such, Company 2 may attribute the characteristic of “organic wheat” to bread that has no chance of physically containing organic wheat (i.e., bread from Bakery D).

In this example, the system boundary (i.e., the company) does not match the boundary for material (i.e., wheat) flows. The amount of organic wheat attributed to the bread that buyers are purchasing is no longer linked to the amount of organic wheat that is physically in the bread that they receive.

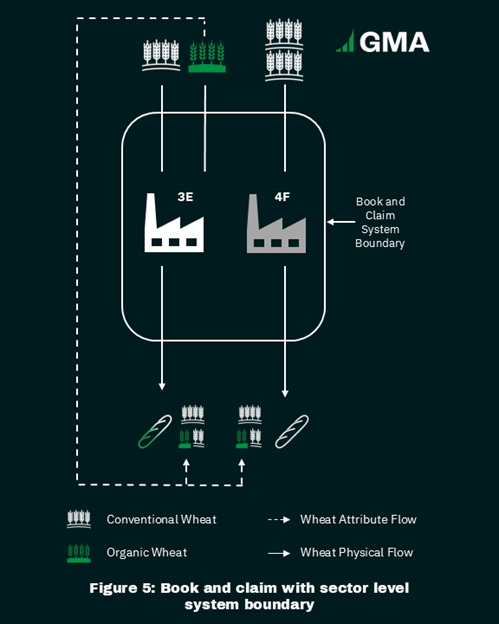

Companies 3 and 4: Book and Claim with a Sector Level System Boundary

Our next two companies each operate one bakery: Company 3 operates Bakery E, and Company 4 operates Bakery F. For the purposes of this example, together these two companies make up the bread sector.

Bakery E receives both conventional wheat and organic wheat from its wheat suppliers. The conventional wheat and organic wheat are mixed together at the bakery and made into bread.

Bakery F does not use any organic wheat. See Figure 5, below.

Company 3 applies a book and claim chain of custody model to attributing wheat characteristics to loaves of bread. Although some organic wheat is in the bread from Bakery E, Company 3 does not trace this wheat. Instead, Company 3 separates the organic attributes from the organic wheat before that organic wheat is mixed with conventional wheat at Bakery E. Company 3 then sells the attributes of that organic wheat to both companies buying bread from its own bakery – Bakery E – as well as to companies buying bread from a different company – Company 4 – which makes bread at Bakery F.

Now, take a look back at Figure 4 and compare it to Figure 5. Even though Company 2 applied a mass balance model and Company 3 applied a book and claim model, in both cases organic wheat characteristics are attributed to loaves of bread that have no chance of physically containing any organic wheat.

CONCLUSION

So is one chain of custody model “better” than another? Does one do a more accurate job of tracking and measuring special characteristics of physical products and giving customers a way to buy materials that “have” those characteristics? Is one model better than another at helping companies achieve their decarbonization goals?

Well, it depends. As we saw in the bakery examples above, the system boundary can have just as big an influence as the chain of custody model on the link – or lack of a link – between the characteristics and the physical composition of a batch of products.

What does this mean for decarbonizing heavy industry? Well, if you buy steel that has been attributed low emission characteristics through a mass balance model, that doesn’t necessarily mean that you will physically receive any low emission steel. The physical steel you receive might be low emission steel… but it also might not be. It depends.

Because the mass balance model maintains a closer tie between physical products and their special characteristics, some people think that the mass balance model is inherently more accurate than book and claim. As we see it, the value of an approach lies in its ability to achieve objectives. If a company’s objective is to support the decarbonization of its physical steel suppliers (meaning, at minimum, it knows who they are and that they are likely to remain the same), then a mass balance approach with a company-wide system boundary will work fine.

If a company has any other objective – for example, if its supply chain isn’t as straightforward as the examples above, then the book and claim model becomes indispensable.

Some may also think that mass balance approaches are inherently more credible than book and claim. The issue of credibility in chain of custody systems will be explored in a future edition of GMA Insights.

[1] Provided that there is not crediting of attributes across mass balancing periods (i.e., the amount of time during which the mass balance is calculated). If Company 1 credited organic wheat attributes across mass balancing periods, there is the possibility that no loaves of bread from one period would contain organic wheat, and that those loaves of bread could be attributed the characteristics of organic wheat from a previous period. For more details on crediting across balancing period, see ISO Standard 22095.

05.23.25

Early Results from GMA’s First Trucking RFP Signal Robust Market for Heavy-duty, Zero-emission Vehicles (ZEVs)

The (preliminary) results are in.

Since launching in 2023, GMA Trucking continues to make major strides in activating the market for zero-emission road freight. The response period for our pilot procurement for zero-emission trucking attributes recently closed, and we’re excited to share that the overall response from carriers has exceeded our expectations.

By the numbers:

With 36 distinct bids from 9 different U.S. carriers, the pilot RFP received more bid volume than our initial expectation, with nearly 900,000,000 annual ton-miles from 760 zero-emission trucks, equivalent to about 145,000 tonnes CO2e abated annually. This demonstrates that carriers, working with OEMs and charging companies, are ready to provide zero emission trucking services when incentivized by appropriate demand signals and market flexibility.

Bids for “net-new” vehicles – defined as vehicles not currently in operation that would be deployed to meet the GMA Trucking RFP demand – made up 69% of bids and comprised 97% of the annual ton-mile volume.

The RFP received bids from 14 states, with bid volumes equally split between California and non-California bids. This geographic diversity, combined with more flexibility in shipping routes, demonstrates the positive influence that a book and claim mechanism can have in spreading zero emission trucking beyond states with more favorable policy incentives and existing charging infrastructure. By engaging with our approach, carriers are able to deploy where it makes the most sense, lowering their overall ZEV operating costs and increasing the emission reduction impact.

What’s next:

The GMA Trucking team has begun the bid evaluation process. We plan to arrive at a shortlist by early June, followed by final selection and contracting. Attributes from these zero emission trucking routes could begin flowing as early as 2026.

While deeper analysis is ongoing, our initial review of responses reveals a strong and consistent message: both the buyer and seller sides of the market are ready for zero-emission trucks. By combining the aggregated demand of our climate-ambitious members with a high integrity book and claim approach, GMA Trucking, alongside strategic partner Smart Freight Centre, is helping accelerate the transition to net-zero heavy duty trucking. We look forward to announcing the pilot RFP winners later this year.

This RFP represents just the first of many planned future procurements. The GMA Trucking program is growing, and we continue to welcome new organizations as members of the buyers alliance. To explore GMA Trucking membership and gain access to current and future purchase opportunities for zero emission trucking service attributes, email trucking@gmacenter.org.

To learn more about GMA Trucking and how we work, see our recent explainer video: